The Ultimate 15Step Guide To Arizona's Paycheck Calculator: Master Your Finances

Mastering Your Finances: A Comprehensive Guide to Arizona's Paycheck Calculator

Understanding your paycheck and managing your finances effectively is crucial for anyone living in Arizona. The state's unique tax landscape and employment regulations can make it challenging to navigate your earnings and deductions accurately. That's where the Arizona Paycheck Calculator comes into play, offering a powerful tool to demystify your pay stub and empower you to take control of your financial future.

Step 1: Accessing the Arizona Paycheck Calculator

The Arizona Paycheck Calculator is a user-friendly online tool provided by the Arizona Department of Revenue. You can access it through the official website, ensuring you have the most up-to-date and accurate information for your calculations.

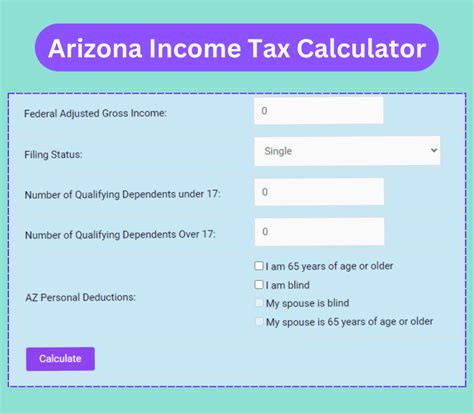

Step 2: Understanding the Calculator's Interface

The calculator's interface is designed to be intuitive and easy to navigate. It consists of several input fields where you'll enter your income details, deductions, and any additional information required for an accurate calculation.

Step 3: Entering Your Gross Income

Gross income refers to your total earnings before any deductions. This includes your regular salary or hourly wages, as well as any additional income sources such as bonuses, commissions, or overtime pay. Ensure you have all the necessary documentation, such as pay stubs or tax forms, to input the correct figures.

Step 4: Calculating Deductions

Deductions are amounts withheld from your gross income for various purposes, such as taxes, insurance, and retirement contributions. The calculator will guide you through entering these deductions accurately. It's important to have a clear understanding of your deductions to ensure an accurate calculation.

Step 5: Inputting Personal Information

The calculator will also require some personal details to provide an accurate estimate. This includes your marital status, number of dependents, and any additional information relevant to your tax situation. Providing accurate personal information is crucial for an precise calculation of your take-home pay.

Step 6: Selecting Your Filing Status

Your filing status, such as single, married filing jointly, or head of household, plays a significant role in determining your tax liability. The calculator will prompt you to select your filing status, ensuring that your calculations align with your specific tax situation.

Step 7: Choosing Your Tax Year

The calculator allows you to choose the tax year for which you want to calculate your paycheck. This feature is particularly useful if you're planning for the future or reviewing past paychecks. Select the appropriate tax year to get an accurate representation of your earnings and deductions.

Step 8: Entering Your Federal Tax Withholding

Federal tax withholding refers to the amount of federal income tax deducted from your paycheck. The calculator will guide you through entering this information, ensuring you provide the correct amount based on your tax bracket and filing status.

Step 9: Calculating State Tax Withholding

Arizona has its own state income tax, and the calculator will help you estimate the amount withheld for state taxes. This step is crucial for understanding your overall tax liability and ensuring compliance with Arizona's tax regulations.

Step 10: Adjusting for Local Taxes

Some areas in Arizona have local taxes in addition to state and federal taxes. The calculator may prompt you to input any local tax information to provide a comprehensive estimate of your deductions.

Step 11: Reviewing Your Results

Once you've entered all the required information, the calculator will generate a detailed breakdown of your paycheck. This includes your gross income, deductions, and your estimated take-home pay. Take the time to review the results carefully to ensure accuracy and understand the impact of each deduction on your earnings.

Step 12: Adjusting Your Withholdings

If you find that your paycheck calculations are not aligning with your financial goals, you can adjust your tax withholdings. The calculator may provide suggestions or recommendations for optimizing your withholdings to ensure you're neither overpaying nor underpaying your taxes.

Step 13: Understanding Tax Credits and Deductions

Arizona offers various tax credits and deductions that can reduce your tax liability. The calculator may provide information on these credits and deductions, helping you maximize your savings and minimize your tax burden.

Step 14: Planning for the Future

The Arizona Paycheck Calculator is not just a tool for understanding your current paycheck. It's also a powerful instrument for financial planning. By using the calculator regularly, you can forecast your earnings and deductions for the upcoming year, helping you make informed decisions about your finances and tax strategy.

Step 15: Seeking Professional Advice

While the Arizona Paycheck Calculator is a valuable resource, it's important to remember that everyone's financial situation is unique. If you have complex tax circumstances or need personalized advice, consider consulting a tax professional or financial advisor. They can provide expert guidance tailored to your specific needs.

Notes

![]() Note: The Arizona Paycheck Calculator is a valuable tool, but it's always recommended to consult official sources and seek professional advice for complex financial matters.

Note: The Arizona Paycheck Calculator is a valuable tool, but it's always recommended to consult official sources and seek professional advice for complex financial matters.

![]() Note: Regularly reviewing your paycheck calculations and seeking professional advice can help you optimize your financial strategy and make informed decisions about your earnings and deductions.

Note: Regularly reviewing your paycheck calculations and seeking professional advice can help you optimize your financial strategy and make informed decisions about your earnings and deductions.

Frequently Asked Questions

What is the Arizona Paycheck Calculator?

+The Arizona Paycheck Calculator is an online tool provided by the Arizona Department of Revenue. It helps individuals estimate their paycheck amounts, including deductions and taxes, based on their income and personal information.

How accurate is the calculator's estimation?

+The calculator provides an accurate estimation based on the information entered. However, it's important to review and verify the calculations with official sources and consider seeking professional advice for complex financial situations.

Can I use the calculator for future financial planning?

+Absolutely! The Arizona Paycheck Calculator is a valuable tool for financial planning. By inputting different income scenarios and adjusting deductions, you can forecast your future earnings and make informed decisions about your financial goals.

Are there any limitations to the calculator's functionality?

+While the calculator is designed to be comprehensive, it may not cover all specific tax situations or unique circumstances. For complex financial matters, it's recommended to consult a tax professional or financial advisor.

Where can I find more information about Arizona's tax regulations?

+The Arizona Department of Revenue's website provides extensive resources and guidelines regarding tax regulations. You can also consult tax professionals or financial advisors for personalized advice.

Final Thoughts

The Arizona Paycheck Calculator is a powerful tool for anyone living in the state, offering a comprehensive understanding of their paycheck and financial situation. By following this step-by-step guide and utilizing the calculator’s features, you can take control of your finances, optimize your earnings, and make informed decisions about your financial future. Remember, while the calculator is a valuable resource, seeking professional advice for complex matters is always recommended.