Pro Tips: Optimize Your Usaa Debit Card Now

Optimize Your USAA Debit Card: Maximize Benefits and Security

The USAA Debit Card offers a range of features and benefits designed to enhance your banking experience. By understanding these features and implementing some simple strategies, you can optimize your debit card usage and make the most of its advantages. In this comprehensive guide, we will explore various aspects of the USAA Debit Card, providing you with valuable insights and pro tips to make your financial life easier and more secure.

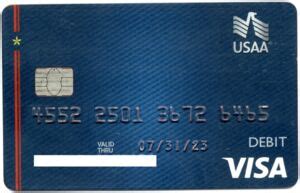

Understanding the USAA Debit Card

The USAA Debit Card is more than just a means of accessing your funds; it’s a powerful tool that comes with a variety of features to simplify your daily transactions. Here’s an overview of what you can expect:

Access to Funds: With your USAA Debit Card, you can conveniently access your checking account funds at any time. Whether it’s making purchases, withdrawing cash, or transferring money, the card provides seamless access to your finances.

Contactless Payments: USAA’s debit cards are equipped with contactless technology, allowing you to make quick and secure payments by tapping your card on a compatible terminal. This feature is especially useful for small purchases, offering a fast and convenient payment method.

Online and Mobile Banking: USAA’s online and mobile banking platforms are designed to provide you with a seamless and secure experience. You can manage your debit card, view transactions, set up alerts, and even freeze your card temporarily if needed, all from the convenience of your device.

Security Features: Security is a top priority for USAA. The debit card is equipped with advanced security measures, including EMV chip technology and fraud monitoring systems. These features help protect your account from unauthorized transactions and ensure your financial information remains secure.

Rewards and Benefits: USAA offers a range of rewards and benefits with its debit card. You can earn cash back on eligible purchases, enjoy discounts and special offers through partnerships, and take advantage of travel benefits, making your debit card usage even more rewarding.

Maximizing Your Debit Card Experience

Now that we have a basic understanding of the USAA Debit Card, let’s dive into some pro tips to optimize your experience:

Set Up Alerts and Notifications

Stay informed about your debit card activity by setting up alerts and notifications. USAA’s mobile app and online banking platform allow you to customize alerts for various transactions, such as purchases above a certain amount, ATM withdrawals, or international transactions. By enabling these alerts, you can quickly identify any suspicious activity and take immediate action if needed.

Utilize Mobile Wallets

Take advantage of mobile wallet services like Apple Pay, Google Pay, or Samsung Pay. These services offer a secure and convenient way to make payments using your USAA Debit Card. Simply add your card to your preferred mobile wallet, and you can make contactless payments with just a tap of your phone. It’s a fast and secure way to pay, especially when you’re on the go.

Take Advantage of Cash Back Rewards

USAA’s debit card rewards program offers an opportunity to earn cash back on your everyday purchases. Maximize your rewards by understanding the categories that offer higher cash back rates. For example, you may earn more cash back on gas station purchases, dining out, or online shopping. Plan your spending accordingly to take full advantage of these rewards.

Manage Your Budget with Categories

USAA’s online and mobile banking platforms provide a powerful tool for budgeting and expense tracking. Utilize the category feature to categorize your transactions, making it easier to track your spending habits and identify areas where you can save. This feature helps you gain better control over your finances and make informed decisions about your budget.

Set Up Auto-Pay for Bills

Simplify your bill payment process by setting up auto-pay for recurring expenses. USAA’s online banking platform allows you to schedule automatic payments for bills such as utilities, subscriptions, or loan payments. By automating these payments, you can ensure timely payments and avoid late fees, providing peace of mind and reducing the stress of managing multiple bills.

Secure Your Card with Travel Notifications

If you’re planning a trip, it’s essential to notify USAA about your travel plans to avoid any potential issues with your debit card. USAA’s online banking platform allows you to set travel notifications, informing the bank about your destination and travel dates. This helps prevent your card from being declined due to suspicious activity in a different location.

Protect Your Card with a PIN

Setting a unique PIN (Personal Identification Number) for your USAA Debit Card adds an extra layer of security. While your card is equipped with EMV chip technology, using a PIN provides an additional safeguard against unauthorized use. Make sure to choose a strong and memorable PIN that only you know.

Freeze Your Card Temporarily

In case of suspected fraud or if you misplace your card, USAA offers a convenient feature to temporarily freeze your debit card. This can be done through the mobile app or online banking platform. Freezing your card prevents any further transactions until you unfreeze it, giving you control over your account and time to resolve any issues.

Security Best Practices

Maintaining the security of your USAA Debit Card is crucial to protect your finances. Here are some best practices to follow:

Regularly Monitor Your Account: Keep a close eye on your account activity by regularly checking your transactions. Review your statements and look for any unfamiliar or suspicious transactions. If you notice any discrepancies, report them to USAA immediately.

Protect Your PIN and Card Information: Treat your PIN and card information with the utmost confidentiality. Avoid sharing your PIN with anyone, and be cautious when entering your PIN at ATMs or merchants. Keep your card in a secure place, and never write down your PIN on the card or in an easily accessible location.

Be Wary of Phishing Attempts: USAA will never ask for your personal or financial information via email or text message. Be cautious of any unsolicited communications claiming to be from USAA. If you receive a suspicious email or text, do not respond or click on any links. Instead, report it to USAA immediately.

Use Secure Wi-Fi Connections: When accessing your USAA account online, ensure you are using a secure and trusted Wi-Fi connection. Avoid using public Wi-Fi networks, as they may not be secure, leaving your information vulnerable to hackers.

Enable Two-Factor Authentication (2FA): Consider enabling two-factor authentication for an extra layer of security. This adds an additional step when logging into your USAA account, requiring a code sent to your phone or email in addition to your password. It provides an extra barrier against unauthorized access.

Additional Benefits and Features

The USAA Debit Card offers a range of additional benefits and features that can enhance your overall banking experience:

Travel Benefits: When you’re traveling, USAA’s debit card provides access to a global ATM network, allowing you to withdraw cash at a lower fee than traditional banks. Additionally, you can enjoy discounts and special offers through USAA’s travel partners, making your travel plans more affordable.

Identity Theft Protection: USAA offers identity theft protection services to its members. This service includes monitoring your credit reports, providing identity theft insurance, and offering resources to help you recover from identity theft. It’s an added layer of protection to keep your personal information secure.

Financial Education Resources: USAA understands the importance of financial literacy. They provide a wealth of educational resources and tools to help you manage your finances effectively. From budgeting tips to investment advice, USAA aims to empower its members with the knowledge to make informed financial decisions.

Conclusion

Optimizing your USAA Debit Card experience involves understanding its features, maximizing its benefits, and prioritizing security. By setting up alerts, utilizing mobile wallets, and taking advantage of rewards and budgeting tools, you can make your daily financial transactions more efficient and rewarding. Additionally, staying vigilant about security and following best practices will help protect your finances and give you peace of mind. Remember, with a little knowledge and proactive management, your USAA Debit Card can become an even more valuable tool in your financial arsenal.

💡 Note: The information provided in this guide is for educational purposes and may not cover all aspects of the USAA Debit Card. Always refer to USAA's official website or contact their customer support for the most accurate and up-to-date information regarding their products and services.

FAQ

Can I use my USAA Debit Card internationally?

+

Yes, you can use your USAA Debit Card internationally. USAA has a global ATM network, and you can withdraw cash at a lower fee than traditional banks. Additionally, you can use your card for purchases in foreign currencies, although you may incur foreign transaction fees.

How do I earn cash back rewards with my USAA Debit Card?

+

To earn cash back rewards, you need to enroll in USAA’s debit card rewards program. Once enrolled, you can earn cash back on eligible purchases, such as gas station transactions, dining out, or online shopping. The specific categories and rewards rates may vary, so check USAA’s website for the latest information.

What should I do if I lose my USAA Debit Card or it’s stolen?

+

If you lose your USAA Debit Card or suspect it has been stolen, it’s important to act quickly. You can temporarily freeze your card through the USAA mobile app or online banking platform to prevent unauthorized transactions. Additionally, contact USAA’s customer support immediately to report the loss or theft and request a replacement card.

How do I change my USAA Debit Card PIN?

+

To change your USAA Debit Card PIN, you can visit a USAA ATM or branch location. Insert your card into the ATM, select the “Change PIN” option, and follow the instructions to create a new PIN. It’s important to choose a unique and secure PIN that you can easily remember.