1. Unleash Your Portfolio: 7 Pro Strategies For Dodge & Cox Stock

Welcome to the world of investing with Dodge & Cox Stock! In this comprehensive guide, we will explore seven powerful strategies to help you unlock the full potential of your portfolio. Whether you are a seasoned investor or just starting your journey, these strategies will provide valuable insights and techniques to enhance your investment approach. So, let's dive right in and discover the secrets to maximizing your returns with Dodge & Cox Stock.

1. Diversify Your Portfolio

Diversification is a fundamental concept in investing, and it plays a crucial role in managing risk and maximizing returns. When it comes to Dodge & Cox Stock, diversifying your portfolio is an essential strategy. By spreading your investments across different asset classes, sectors, and geographic regions, you can mitigate the impact of market volatility and potential losses. Here's how you can achieve diversification with Dodge & Cox Stock:

- Asset Allocation: Allocate your investments across various asset classes such as stocks, bonds, and cash equivalents. Dodge & Cox offers a range of mutual funds that cater to different investment objectives, allowing you to create a well-balanced portfolio.

- Sector Allocation: Diversify your stock holdings by investing in different sectors. Dodge & Cox funds often have a diverse sector allocation, ensuring that your portfolio is not overly exposed to any specific industry.

- Geographic Diversification: Consider investing in funds that have a global focus. Dodge & Cox has a presence in international markets, allowing you to tap into opportunities beyond your domestic boundaries.

By diversifying your portfolio, you can reduce the impact of individual stock or sector fluctuations and create a more stable investment foundation.

2. Long-Term Investment Horizon

Investing in Dodge & Cox Stock requires a long-term perspective. While short-term market fluctuations can be tempting to react to, a long-term investment horizon is crucial for maximizing returns. Here's why adopting a long-term approach is beneficial:

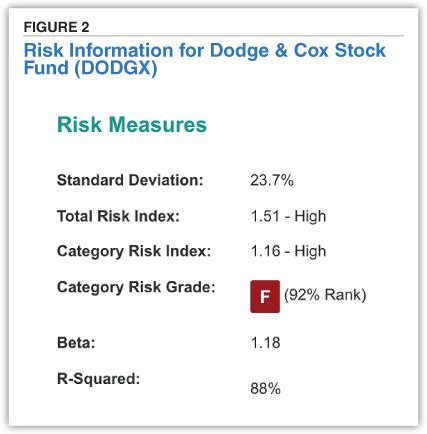

- Market Volatility: Stock markets are inherently volatile, and short-term price movements can be influenced by various factors. By maintaining a long-term perspective, you can ride out temporary market downturns and focus on the long-term growth potential of your investments.

- Compound Interest: The power of compound interest is a key advantage of long-term investing. By reinvesting your dividends and allowing your investments to grow over an extended period, you can achieve significant wealth accumulation.

- Avoiding Emotional Decisions: Short-term market movements can lead to emotional decision-making, which often results in poor investment choices. A long-term investment strategy helps you stay disciplined and avoid making impulsive decisions based on short-term market noise.

Remember, investing in Dodge & Cox Stock is a marathon, not a sprint. Embrace the long-term investment horizon to unlock the full potential of your portfolio.

3. Regular Monitoring and Rebalancing

While a long-term investment horizon is crucial, it's essential to regularly monitor and rebalance your portfolio. Market conditions and the performance of individual stocks can change over time, and it's important to ensure your portfolio remains aligned with your investment goals. Here's how you can effectively monitor and rebalance your Dodge & Cox Stock portfolio:

- Set Investment Goals: Clearly define your investment objectives and the desired asset allocation for your portfolio. This will serve as a benchmark for monitoring and rebalancing.

- Regular Reviews: Schedule periodic reviews of your portfolio. Assess the performance of your investments, compare them to your benchmarks, and identify any deviations.

- Rebalance as Needed: If your portfolio deviates significantly from your desired asset allocation, consider rebalancing. This involves buying or selling assets to bring your portfolio back in line with your investment goals. Dodge & Cox offers a range of mutual funds, making it easier to adjust your portfolio composition.

By regularly monitoring and rebalancing your portfolio, you can ensure that your investments remain on track and aligned with your long-term objectives.

4. Dollar-Cost Averaging

Dollar-cost averaging is a powerful strategy for investing in Dodge & Cox Stock, especially for those who are new to investing or prefer a more systematic approach. This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. Here's how dollar-cost averaging can benefit your investment journey:

- Reducing Market Timing Risk: By investing a fixed amount regularly, you avoid the need to time the market perfectly. Market timing is a challenging endeavor, and dollar-cost averaging helps you mitigate this risk.

- Lower Average Cost: Over time, dollar-cost averaging can result in a lower average cost per share. This is because you are buying more shares when the price is low and fewer shares when the price is high, effectively lowering your overall average cost.

- Disciplined Investing: Dollar-cost averaging promotes a disciplined approach to investing. By investing regularly, you remove the emotional aspect of buying or selling based on short-term market movements.

Consider implementing dollar-cost averaging as a strategy to build your Dodge & Cox Stock portfolio over time, especially if you are investing for the long term.

5. Focus on Quality and Value

When investing in Dodge & Cox Stock, it's important to focus on quality and value. Dodge & Cox is known for its disciplined investment approach, which emphasizes investing in high-quality companies with strong fundamentals. Here's how you can incorporate a quality and value-focused strategy into your investment journey:

- Research and Analysis: Conduct thorough research and analysis before investing in any stock. Evaluate the company's financial health, competitive advantage, management team, and long-term growth prospects. Dodge & Cox funds often invest in companies with strong fundamentals, so aligning your research with their investment philosophy can be beneficial.

- Quality over Quantity: Instead of chasing short-term gains, focus on investing in high-quality companies that have the potential for long-term growth. Quality companies often have a track record of consistent performance and can weather market downturns more effectively.

- Value Investing: Consider the concept of value investing, which involves identifying undervalued stocks with the potential for future growth. Dodge & Cox is known for its value-oriented investment approach, so understanding the principles of value investing can enhance your investment decisions.

By focusing on quality and value, you can build a portfolio of strong, resilient companies that have the potential to deliver long-term returns.

6. Embrace Diversification within Dodge & Cox Funds

Dodge & Cox offers a range of mutual funds, each with its own investment strategy and focus. Embracing diversification within Dodge & Cox funds can further enhance your investment portfolio. Here's how you can utilize the diversity of Dodge & Cox funds:

- International Exposure: Consider investing in Dodge & Cox's international funds to gain exposure to global markets. This allows you to diversify beyond your domestic market and tap into international growth opportunities.

- Sector-Specific Funds: If you have a specific sector interest, Dodge & Cox offers sector-specific funds. Whether it's healthcare, technology, or energy, you can invest in funds that focus on your preferred industry.

- Balanced Approach: Dodge & Cox also offers balanced funds that combine stocks and bonds, providing a more conservative investment approach. These funds can be a great option for investors seeking a diversified portfolio with a lower risk profile.

By exploring the various Dodge & Cox funds, you can create a well-rounded and diversified investment portfolio that aligns with your risk tolerance and investment goals.

7. Stay Informed and Educate Yourself

Investing in Dodge & Cox Stock requires a certain level of financial literacy and knowledge. To make informed investment decisions, it's crucial to stay informed and continuously educate yourself. Here are some tips to enhance your investment knowledge:

- Read and Research: Stay updated on financial news, market trends, and investment strategies. Read reputable financial publications, follow trusted analysts, and research investment opportunities thoroughly.

- Attend Webinars and Workshops: Participate in webinars and workshops conducted by financial experts and investment professionals. These events can provide valuable insights and help you stay abreast of the latest investment trends.

- Seek Professional Advice: Consider consulting with a financial advisor or investment professional. They can provide personalized guidance based on your financial goals and risk tolerance, ensuring that your investment strategy is tailored to your needs.

By staying informed and continuously educating yourself, you can make more informed investment decisions and navigate the investment landscape with confidence.

Conclusion

Investing in Dodge & Cox Stock offers a wealth of opportunities for growth and wealth accumulation. By implementing these seven pro strategies, you can unleash the full potential of your portfolio. Remember, diversification, a long-term investment horizon, regular monitoring, and a focus on quality and value are key principles to keep in mind. Embrace the power of Dodge & Cox funds, stay informed, and watch your investments flourish over time. Happy investing!

What is Dodge & Cox Stock known for?

+Dodge & Cox is renowned for its disciplined investment approach, focusing on high-quality companies with strong fundamentals. Their mutual funds often invest in well-established companies with a track record of consistent performance.

How often should I rebalance my Dodge & Cox Stock portfolio?

+The frequency of rebalancing depends on your investment goals and risk tolerance. As a general guideline, consider reviewing and rebalancing your portfolio annually or whenever there are significant changes in market conditions or your investment objectives.

Can I invest in Dodge & Cox Stock directly, or do I need to go through a broker?

+Dodge & Cox funds are typically available through brokerage firms or financial advisors. You can open an account with a broker or consult with a financial professional to invest in Dodge & Cox mutual funds.

What are the benefits of investing in Dodge & Cox’s international funds?

+Investing in Dodge & Cox’s international funds allows you to diversify your portfolio beyond your domestic market. It provides exposure to global growth opportunities and helps mitigate the impact of local market volatility.

How can I stay updated on financial news and investment trends?

+Staying informed is crucial for successful investing. Follow reputable financial news sources, subscribe to investment newsletters, and engage with financial communities online. Additionally, consider attending webinars and workshops to enhance your investment knowledge.