Veteran Debt Assistance Reviews

Understanding Veteran Debt Assistance: A Comprehensive Guide

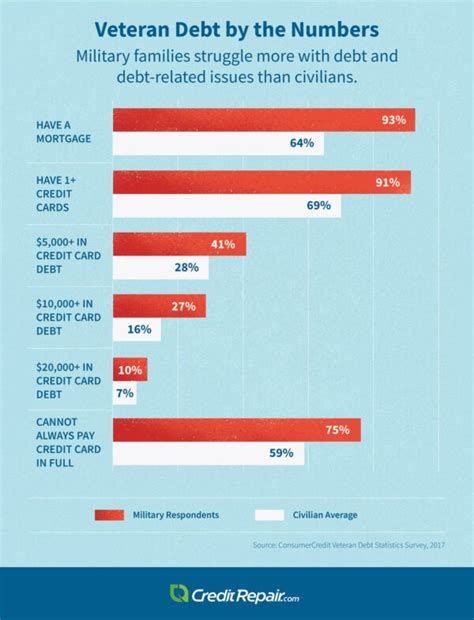

Veterans, who have served our nation with honor and dedication, often face unique financial challenges post-service. One such challenge is managing debt, which can be overwhelming without the right support and resources. Fortunately, there are various debt assistance programs designed specifically for veterans, offering tailored solutions to help them regain financial stability. In this comprehensive guide, we will explore these programs, their benefits, and how veterans can access them to secure a brighter financial future.

The Importance of Veteran Debt Assistance

Veterans, having dedicated their lives to serving the country, may encounter financial obstacles upon their return to civilian life. These challenges can include adjusting to a new financial landscape, managing unexpected expenses, and coping with the physical and mental health issues that often accompany military service. Debt assistance programs for veterans aim to provide a safety net, offering tailored solutions to help them navigate these financial hurdles.

Exploring Debt Assistance Programs for Veterans

VA Debt Management Program

The VA Debt Management Program is a cornerstone of veteran debt assistance, offering a range of services to help veterans manage and repay their debts. This program provides personalized support, including debt counseling, budget planning, and assistance with debt repayment plans. Veterans can access this program through the Department of Veterans Affairs (VA) website or by contacting their local VA office.

VA Home Loan Guaranty Program

The VA Home Loan Guaranty Program is a valuable resource for veterans seeking to purchase a home. This program offers low-interest loans with flexible terms, making homeownership more accessible. By providing a guarantee to lenders, the VA reduces the risk associated with offering loans to veterans, making it easier for them to secure financing.

VA Pension Program

The VA Pension Program is designed to provide financial support to veterans with limited income and assets. This program offers monthly payments to eligible veterans, helping them cover basic living expenses. The VA Pension Program is particularly beneficial for veterans who may have difficulty securing traditional forms of income due to service-related disabilities or other factors.

VA Education Benefits

The VA offers a range of education benefits to help veterans pursue further education and training. These benefits can include tuition assistance, book stipends, and living expenses while enrolled in an approved program. By investing in their education, veterans can enhance their career prospects and increase their earning potential, ultimately improving their financial stability.

VA Vocational Rehabilitation and Employment Program

The VA Vocational Rehabilitation and Employment (VR&E) Program is tailored to assist veterans with service-connected disabilities in finding meaningful employment. This program provides career counseling, job training, and placement services, helping veterans transition into civilian careers that align with their skills and interests. By supporting veterans in gaining stable employment, the VR&E Program plays a crucial role in their financial well-being.

How to Access Veteran Debt Assistance Programs

Step 1: Determine Eligibility

The first step in accessing veteran debt assistance programs is to determine your eligibility. Each program has specific criteria, including factors such as military service history, disability status, and financial need. Review the eligibility requirements for each program carefully to understand your qualifications.

Step 2: Gather Required Documentation

Once you have determined your eligibility, gather the necessary documentation to support your application. This may include military service records, medical records, financial statements, and other relevant documents. Having these documents readily available will streamline the application process.

Step 3: Apply for the Program

Apply for the program that best suits your needs. You can apply online through the VA’s website or by visiting your local VA office. Ensure that you complete the application accurately and provide all the required information. If you have any questions or need assistance, don’t hesitate to reach out to the VA’s helpline or seek support from veteran service organizations.

Step 4: Attend Counseling Sessions (if applicable)

Some debt assistance programs, such as the VA Debt Management Program, may require you to attend counseling sessions. These sessions are designed to provide you with personalized guidance and support in managing your debt. Attend these sessions regularly and actively participate to maximize the benefits of the program.

Step 5: Repay Your Debts (if applicable)

If you are enrolled in a debt repayment program, such as the VA Debt Management Program, it is crucial to make timely payments to repay your debts. Stick to the repayment plan outlined by the program and seek assistance if you encounter any financial difficulties. Remember, the goal is to regain financial stability and build a solid credit history.

Success Stories: Veteran Debt Assistance in Action

John’s Story

John, a veteran who served in the Marine Corps, faced significant financial challenges upon his return to civilian life. He struggled with debt and was unable to secure a stable job due to service-related injuries. Through the VA Vocational Rehabilitation and Employment Program, John received career counseling and job training. He was matched with an employer who valued his military experience and offered him a position as a project manager. With a steady income and the support of the VA’s debt management program, John was able to repay his debts and achieve financial stability.

Sarah’s Story

Sarah, a veteran of the Army, wanted to pursue a degree in nursing but faced financial obstacles. The VA Education Benefits program provided her with the necessary funding to cover her tuition, books, and living expenses while enrolled in an accredited nursing program. With this support, Sarah was able to focus on her studies and successfully complete her degree. Today, she works as a registered nurse, earning a stable income and contributing to her community.

Key Takeaways

- Veteran debt assistance programs offer a range of services, including debt management, home loans, pensions, education benefits, and vocational rehabilitation.

- These programs are designed to help veterans overcome financial challenges and achieve long-term financial stability.

- Accessing these programs involves determining eligibility, gathering documentation, and applying through the VA’s website or local office.

- Success stories like John’s and Sarah’s highlight the transformative impact of veteran debt assistance programs on individuals’ lives.

Frequently Asked Questions (FAQs)

How do I know if I'm eligible for veteran debt assistance programs?

+Eligibility criteria vary depending on the program. Generally, veterans with honorable discharges and certain service-connected disabilities may qualify. Review the specific requirements for each program to determine your eligibility.

Can I apply for multiple veteran debt assistance programs simultaneously?

+Yes, you can apply for multiple programs simultaneously if you meet the eligibility criteria for each. However, it's important to carefully review the terms and conditions of each program to ensure they align with your needs and circumstances.

What if I'm having difficulty making payments under a debt repayment plan?

+If you're facing financial challenges, contact the program administrator or a veteran service organization for assistance. They can provide guidance and support to help you navigate through difficult financial situations.

Are there any penalties for defaulting on a VA loan?

+Defaulting on a VA loan can have serious consequences, including damage to your credit score and potential legal action. It's crucial to communicate with your loan servicer if you're experiencing financial difficulties to explore alternative repayment options.

How long does it take to receive benefits from the VA Pension Program?

+The processing time for VA Pension Program benefits can vary. It typically takes several months to receive a decision, but factors such as the completeness of your application and the volume of applications can impact the timeline.

Veteran debt assistance programs are a vital resource for veterans seeking to overcome financial challenges and secure a stable future. By understanding the available programs, determining eligibility, and taking the necessary steps to access these resources, veterans can regain control of their financial well-being and build a brighter future.