Usaa Life Insurance Rates

Understanding USAA Life Insurance Rates

USAA offers a range of life insurance options to cater to the diverse needs of its members. Whether you’re looking for affordable coverage or more comprehensive protection, understanding the factors that influence USAA life insurance rates is essential. In this blog post, we’ll delve into the key aspects that impact these rates and provide you with valuable insights to make informed decisions.

Factors Influencing USAA Life Insurance Rates

Age: One of the primary factors that affect life insurance rates is your age. Generally, younger individuals are offered lower rates as they are considered to have a longer life expectancy. As you grow older, the rates tend to increase due to the higher risk associated with advancing age.

Health Status: Your overall health plays a significant role in determining life insurance rates. USAA, like other insurance providers, assesses your medical history, lifestyle habits, and any pre-existing conditions to evaluate your risk profile. Maintaining a healthy lifestyle and managing any health issues can positively impact your rates.

Coverage Amount: The amount of coverage you require directly influences the premium you pay. Higher coverage amounts typically result in higher premiums. It’s important to find a balance between the coverage you need and what you can afford.

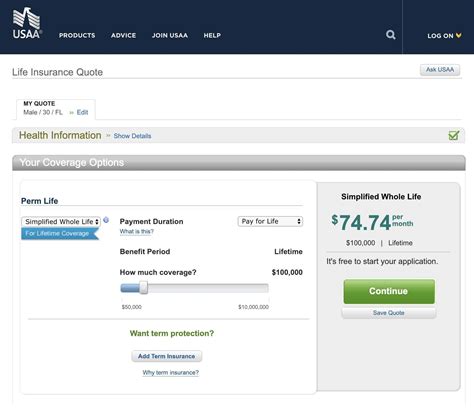

Policy Type: USAA offers various life insurance policy types, including term life and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage. The type of policy you choose will impact your rates, with term life insurance often being more affordable in the short term.

Tobacco Use: If you use tobacco products, you may face higher life insurance rates. Smoking and other forms of tobacco use are considered risk factors, as they can increase the likelihood of health issues. Being tobacco-free can lead to more favorable rates.

Family History: Your family’s medical history can also be a factor in determining life insurance rates. Genetic conditions or a history of certain illnesses within your family may impact your risk assessment.

Occupation and Hobbies: Your occupation and hobbies can influence your life insurance rates. High-risk occupations or hobbies that involve dangerous activities may result in higher premiums. USAA considers these factors to assess your overall risk level.

Credit Score: In some cases, your credit score may be taken into account when determining life insurance rates. A good credit score can indicate financial stability and may result in more favorable rates.

Payment Frequency: The frequency of your premium payments can impact your overall rate. Paying premiums annually or semi-annually may lead to lower rates compared to monthly payments.

Tips for Getting the Best USAA Life Insurance Rates

- Shop Around: Compare rates from different insurance providers, including USAA, to find the best deal.

- Maintain a Healthy Lifestyle: Leading a healthy lifestyle can improve your overall health and potentially lower your life insurance rates.

- Quit Tobacco: If you use tobacco, consider quitting to reduce your risk profile and potentially lower your rates.

- Choose the Right Coverage: Assess your needs and choose a coverage amount that provides adequate protection without being excessive.

- Review Your Policy Regularly: Regularly review your life insurance policy to ensure it aligns with your changing needs and circumstances.

- Bundle Policies: Consider bundling your life insurance with other USAA policies, such as auto or homeowners insurance, to potentially save on overall costs.

The Application Process

To obtain a USAA life insurance policy, you’ll need to go through an application process. This typically involves the following steps:

- Obtain a Quote: Start by getting a quote based on your age, health status, and coverage needs.

- Complete an Application: Fill out an application form, providing detailed information about your health, lifestyle, and family history.

- Medical Examination: In some cases, a medical examination may be required to assess your health status.

- Underwriting Review: USAA’s underwriting team will review your application and medical examination (if applicable) to determine your risk profile and set your premium rate.

- Policy Issuance: Once your application is approved, you’ll receive your life insurance policy, outlining the coverage terms and conditions.

Important Notes

🌟 Note: USAA life insurance rates are subject to change based on individual circumstances and market conditions. It's essential to review your policy regularly to ensure it meets your needs.

🤝 Note: USAA offers a range of life insurance options, including term life, whole life, and universal life insurance. Choose the policy type that best aligns with your financial goals and budget.

Conclusion

Understanding the factors that influence USAA life insurance rates empowers you to make informed decisions about your coverage. By considering your age, health status, coverage amount, and other relevant factors, you can find a policy that provides the protection you need at a rate you can afford. Remember to regularly review your policy and explore opportunities to optimize your coverage and premiums.

FAQ

Can I get USAA life insurance if I have a pre-existing medical condition?

+

Yes, USAA offers life insurance to individuals with pre-existing medical conditions. However, the rates may be higher, and the coverage may be subject to certain exclusions or limitations.

Are there any discounts available for USAA life insurance policies?

+

USAA offers various discounts on life insurance policies, such as the Military Service Discount and the Automatic Premium Loan Discount. These discounts can help reduce your overall premium costs.

Can I add additional coverage to my USAA life insurance policy later on?

+

Yes, you can typically add additional coverage to your USAA life insurance policy at any time. However, this may require a new application and underwriting process.