Ultimate Guide: 10 Steps To Expert Payroll Management

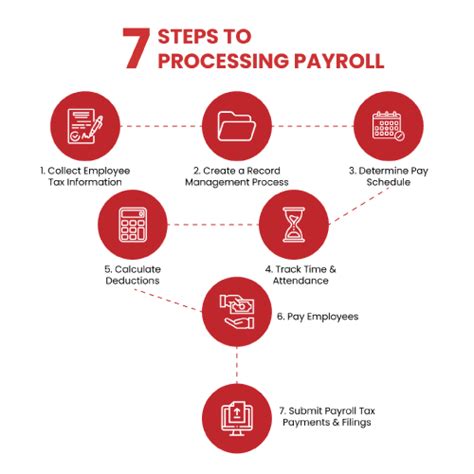

Step 1: Understanding the Basics of Payroll

Payroll management is a crucial aspect of any business, ensuring employees receive accurate and timely compensation for their work. It involves a series of complex processes, from calculating wages and deductions to managing tax obligations and compliance. To become an expert in payroll management, it’s essential to grasp the fundamentals and build a solid foundation.

Key Components of Payroll: - Gross Pay: This is the total amount earned by an employee before any deductions. It includes base salary, overtime pay, bonuses, and any other earnings. - Deductions: Deductions are amounts withheld from an employee’s gross pay. These include taxes (federal, state, and local), social security and Medicare contributions, and any voluntary deductions like retirement plan contributions or insurance premiums. - Net Pay: Net pay is the amount an employee takes home after all deductions have been made. It represents the actual compensation received.

Step 2: Compliance with Laws and Regulations

One of the most critical aspects of payroll management is ensuring compliance with relevant laws and regulations. Non-compliance can lead to severe penalties and legal issues for your business. Stay up-to-date with the following:

- Employment Laws: Familiarize yourself with federal and state employment laws, such as the Fair Labor Standards Act (FLSA), which sets minimum wage and overtime pay standards.

- Tax Laws: Understand tax laws and regulations, including income tax withholding, social security, and Medicare contributions.

- Payroll Reporting: Learn about the reporting requirements for payroll, such as filing tax forms and maintaining accurate records.

Step 3: Choosing the Right Payroll Software

Selecting the appropriate payroll software is crucial for efficient and accurate payroll management. Here are some factors to consider:

- Ease of Use: Opt for user-friendly software that simplifies payroll processing and minimizes errors.

- Features: Look for software that offers essential features like automatic tax calculations, payroll reporting, and integration with accounting systems.

- Scalability: Choose a software that can grow with your business, accommodating an increasing number of employees and changing payroll needs.

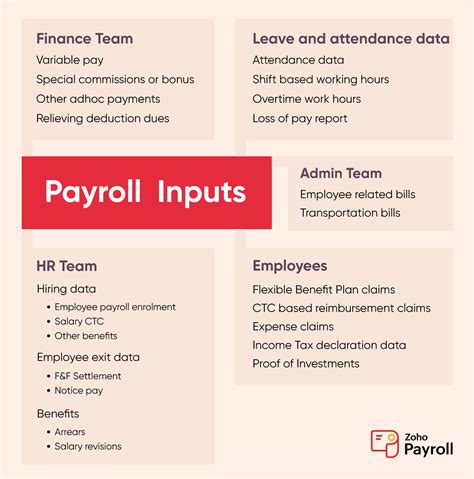

Step 4: Employee Onboarding and Data Collection

Accurate employee data is the cornerstone of effective payroll management. During the onboarding process, collect essential information, including:

- Personal Details: Name, address, contact information, and date of birth.

- Tax Information: Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Bank Details: Account information for direct deposit.

- Payroll Deductions: Employee-elected deductions like retirement plans, health insurance, or union dues.

Step 5: Calculating Gross Pay

Gross pay calculation is a critical step in payroll management. It involves determining the total earnings of an employee, including:

- Base Salary: The regular salary or wage agreed upon in the employment contract.

- Overtime Pay: Additional pay for hours worked beyond the standard workweek, calculated at 1.5 times the regular rate.

- Bonuses and Commissions: Incentive payments based on performance or sales targets.

- Other Earnings: Any other payments, such as shift differentials or allowances.

Step 6: Deductions and Withholdings

Deductions and withholdings are essential components of payroll management, as they ensure employees’ contributions to various programs and the accurate calculation of net pay. Here’s a breakdown:

- Tax Withholdings: Federal income tax, state income tax (if applicable), and local taxes are withheld based on the employee’s filing status and allowances.

- Social Security and Medicare: These are mandatory contributions for social security and Medicare programs.

- Voluntary Deductions: Employee-elected deductions, such as retirement plan contributions, health insurance premiums, or charitable donations.

Step 7: Net Pay Calculation

Net pay is the take-home pay an employee receives after all deductions have been made. To calculate net pay:

- Subtract Deductions: Deduct all applicable withholdings and contributions from the gross pay.

- Final Net Pay: The remaining amount is the employee’s net pay, which can be distributed via direct deposit or check.

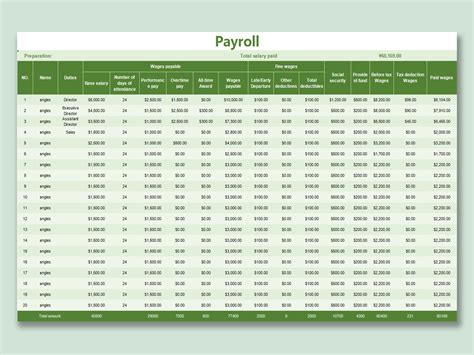

Step 8: Payroll Reporting and Recordkeeping

Accurate payroll reporting and recordkeeping are essential for compliance and audit purposes. Here’s what you need to do:

- Payroll Registers: Maintain detailed payroll registers that include employee information, gross pay, deductions, and net pay for each pay period.

- Tax Reporting: File tax forms with the appropriate authorities, such as the IRS and state tax agencies, to report payroll taxes withheld and remitted.

- Record Retention: Keep payroll records for a minimum of three to four years, as required by law.

Step 9: Managing Payroll Taxes

Payroll taxes are a significant responsibility for employers and must be managed carefully. Here’s an overview:

- Federal Taxes: Withhold and remit federal income taxes, social security taxes, and Medicare taxes.

- State and Local Taxes: Understand and comply with state and local tax laws, including income tax withholding and unemployment insurance contributions.

- Quarterly and Annual Tax Filings: File and pay payroll taxes on a quarterly and annual basis, as required.

Step 10: Regular Payroll Audits and Reviews

Conducting regular payroll audits and reviews is essential to ensure accuracy and compliance. Here are some key practices:

- Audit Payroll Registers: Review payroll registers for accuracy and ensure all calculations are correct.

- Verify Tax Withholdings: Check that tax withholdings match the employee’s tax status and allowances.

- Reconcile Payroll Accounts: Compare payroll records with accounting records to ensure accuracy and identify any discrepancies.

- Stay Updated: Keep up-to-date with any changes in laws and regulations that may impact payroll.

Notes:

- Always stay informed about any updates or changes in employment and tax laws to ensure compliance.

- Regularly back up your payroll data to prevent data loss and ensure business continuity.

- Consider seeking professional advice or using payroll services for complex payroll management tasks.

Conclusion:

Payroll management is a complex but crucial process for any business. By understanding the basics, staying compliant with laws, and utilizing efficient payroll software, you can ensure accurate and timely compensation for your employees. Remember to collect accurate employee data, calculate gross and net pay correctly, and manage payroll taxes diligently. Regular audits and reviews will help maintain compliance and identify any potential issues. With these steps, you can become an expert in payroll management and contribute to the smooth operation of your business.

FAQ:

What are the key components of payroll management?

+Payroll management involves several critical components, including gross pay calculation, deductions and withholdings, net pay calculation, payroll reporting, and managing payroll taxes.

How often should I conduct payroll audits and reviews?

+It is recommended to conduct payroll audits and reviews at least once a year, but more frequent reviews, such as quarterly or bi-annually, can help identify and address any issues promptly.

What are the consequences of non-compliance with payroll regulations?

+Non-compliance with payroll regulations can result in severe penalties, including fines, interest charges, and legal actions. It can also damage your business’s reputation and lead to employee dissatisfaction.

Can I use a payroll service provider for my business?

+Yes, many businesses opt for payroll service providers to handle complex payroll tasks, ensuring accuracy and compliance. These providers offer expertise and can save time and resources for your business.

How can I stay updated with changes in payroll laws and regulations?

+Stay informed by subscribing to newsletters or alerts from government agencies, such as the IRS and state tax authorities. Additionally, consult with payroll professionals or use reliable payroll software that provides updates on regulatory changes.