The Ultimate 8Step Guide To Design Your Wsu Tuition Plan

Creating a well-thought-out tuition plan is essential for managing your finances effectively while pursuing your education at Washington State University (WSU). In this comprehensive guide, we will walk you through the process of designing a personalized tuition plan, ensuring you have a clear roadmap to achieve your academic goals without breaking the bank.

Step 1: Understand Your Financial Aid Options

Before delving into your tuition plan, it's crucial to familiarize yourself with the various financial aid opportunities available at WSU. Explore the following options:

- Scholarships: WSU offers a wide range of scholarships based on merit, need, and specific criteria. Research and apply for scholarships that align with your qualifications and interests.

- Grants: Grants are often need-based and do not require repayment. Check if you are eligible for federal or state grants, as well as any institutional grants provided by WSU.

- Work-Study Programs: These programs allow students to work part-time jobs on or off-campus to earn money for their education. Explore work-study opportunities to gain valuable work experience and offset tuition costs.

- Loans: If you need additional funding, consider student loans. Research different loan options, including federal loans, private loans, and institutional loans offered by WSU. Understand the terms, interest rates, and repayment plans associated with each loan type.

Step 2: Calculate Your Expected Tuition and Fees

Determining the total cost of your education is a critical step in designing your tuition plan. Visit the WSU website or contact the Financial Aid Office to obtain accurate information about tuition and fees for your specific program and residency status.

Make sure to consider the following:

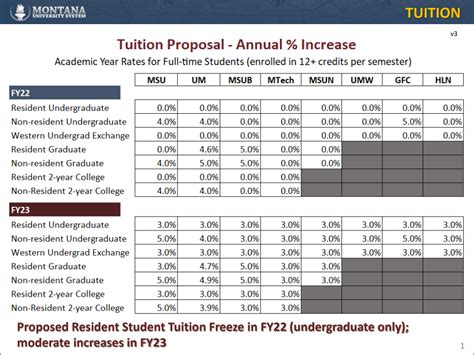

- Tuition: Understand the tuition rates for in-state and out-of-state students, as well as any potential increases over the duration of your studies.

- Fees: In addition to tuition, there may be various fees such as registration fees, technology fees, health services fees, and other mandatory charges. Include these in your calculations.

- Room and Board: If you plan to live on campus, factor in the cost of housing and meal plans. Consider comparing on-campus and off-campus living options to find the most cost-effective solution for your needs.

- Books and Supplies: Estimate the cost of textbooks, course materials, and any additional supplies required for your program. You can often find this information on the WSU website or by consulting with current students or alumni.

Step 3: Assess Your Personal Finances

Evaluating your financial situation is essential to determining how much you can contribute to your tuition plan. Take into account the following factors:

- Savings: If you have saved money specifically for your education, calculate the amount available and consider how it fits into your overall tuition plan.

- Income: Assess your current income sources, such as part-time jobs, allowances, or any other financial support you receive. Determine how much you can reasonably contribute towards your tuition each semester or year.

- Expenses: Make a list of your monthly or annual expenses, including rent, utilities, transportation, groceries, and other personal needs. Understanding your spending habits will help you allocate funds effectively for your tuition plan.

Step 4: Create a Realistic Budget

Developing a budget is a crucial step in managing your finances effectively. Here's how to create a realistic budget for your tuition plan:

- List Income Sources: Start by listing all your income sources, including financial aid, scholarships, grants, work-study earnings, and any personal contributions. Ensure you understand the timing and amount of each income source.

- Calculate Total Income: Add up all your income sources to determine your total income for the academic year. This will give you a clear picture of the funds available to cover your tuition and other expenses.

- Estimate Expenses: Build on your assessment of personal finances by estimating your expenses more precisely. Include tuition and fees, books and supplies, room and board, transportation, and any other relevant costs. Be as accurate as possible to ensure your budget is realistic.

- Subtract Expenses from Income: Subtract your total estimated expenses from your total income. If you have a positive balance, you're on the right track. If there's a deficit, you may need to explore additional funding options or make adjustments to your budget.

Step 5: Explore Payment Plans and Options

WSU offers various payment plans and options to help students manage their tuition expenses. Familiarize yourself with the following:

- Payment Plans: WSU provides payment plans that allow you to spread out your tuition payments over multiple installments. Explore the different plans available and choose the one that best fits your financial situation. Consider factors such as the number of installments, due dates, and any associated fees.

- Tuition Management Systems: Some students may benefit from tuition management systems that help them manage their tuition payments more efficiently. These systems often offer features like automatic payments, payment tracking, and reminders.

- Payment Methods: Understand the different payment methods accepted by WSU, such as credit cards, bank transfers, or checks. Choose the most convenient and cost-effective method for your circumstances.

Step 6: Utilize Savings and Investment Strategies

Maximizing your savings and exploring investment opportunities can significantly impact your tuition plan. Consider the following strategies:

- 529 College Savings Plans: Research and consider opening a 529 college savings plan, which is a tax-advantaged investment vehicle specifically designed for education expenses. These plans offer various investment options and potential tax benefits.

- Education Savings Accounts (ESAs): ESAs are another savings option that allows you to set aside funds for education-related expenses. Consult with a financial advisor to understand the eligibility criteria and benefits of ESAs.

- Investment Options: If you have a longer time horizon, explore investment opportunities such as stocks, bonds, or mutual funds. However, be cautious and seek professional advice to minimize risks and make informed investment decisions.

Step 7: Stay Informed and Seek Support

Staying informed about financial aid opportunities and seeking support when needed is crucial for the success of your tuition plan. Here are some tips:

- Stay Updated: Regularly check the WSU website, financial aid office, and other relevant resources for updates on financial aid programs, scholarship opportunities, and changes in tuition policies.

- Attend Financial Aid Workshops: Participate in financial aid workshops or information sessions organized by WSU. These events provide valuable insights and guidance on navigating the financial aid process and maximizing your resources.

- Consult Financial Advisors: If you have complex financial circumstances or need specialized advice, consider consulting with a financial advisor. They can help you optimize your savings, investment strategies, and overall financial planning.

Step 8: Monitor and Adjust Your Plan Regularly

Your tuition plan is not set in stone; it should be a dynamic process that adapts to your changing circumstances. Here's how to effectively monitor and adjust your plan:

- Review Your Budget Regularly: Set aside time each semester or year to review your budget and assess your financial situation. Compare your actual expenses with your estimated expenses and make adjustments as needed. This will help you stay on track and identify any potential financial challenges early on.

- Explore Additional Funding Sources: If you find that your current plan is not sufficient to cover your tuition and expenses, explore additional funding sources. Consider applying for external scholarships, grants, or part-time employment opportunities. Stay proactive in seeking out new financial aid options.

- Communicate with the Financial Aid Office: Maintain open communication with the WSU Financial Aid Office. They can provide valuable guidance, assist with any issues or concerns, and help you navigate changes in financial aid policies or requirements.

By following these eight steps and staying committed to your tuition plan, you can effectively manage your finances and achieve your academic goals at Washington State University. Remember, creating a successful tuition plan requires organization, discipline, and a proactive approach to financial management.

What are the key factors to consider when creating a tuition plan for WSU?

+When designing your WSU tuition plan, it’s crucial to consider factors such as financial aid options, expected tuition and fees, personal finances, budgeting, payment plans, savings strategies, and staying informed about financial aid opportunities. These elements will help you create a comprehensive and effective plan.

How can I maximize my financial aid opportunities at WSU?

+To maximize your financial aid opportunities, thoroughly research and apply for scholarships, grants, and work-study programs offered by WSU. Stay updated on application deadlines and requirements, and consider seeking guidance from the financial aid office or attending financial aid workshops.

Are there any specific payment plans available at WSU for international students?

+Yes, WSU offers payment plans specifically designed for international students. These plans often provide flexibility and allow students to pay their tuition in multiple installments. Contact the international student services office or the financial aid office for more information on the available payment plans and their requirements.

Can I negotiate my tuition fees at WSU?

+While tuition fees are typically set by the university, there may be limited opportunities for negotiation, especially for students with extenuating circumstances or exceptional financial need. It’s best to consult with the financial aid office or the relevant department to discuss your options and explore potential alternatives.

What should I do if I encounter financial difficulties during my studies at WSU?

+If you face financial difficulties, it’s important to reach out to the financial aid office as soon as possible. They can provide guidance, assist with exploring additional funding options, and help you understand the available resources and support systems at WSU. Early communication is key to finding a solution.