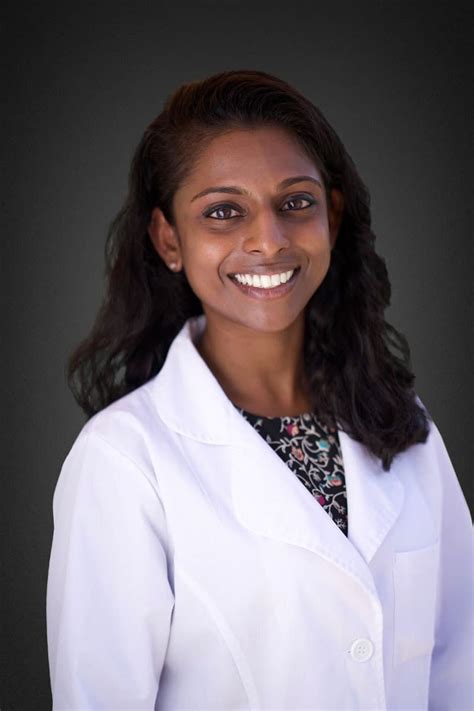

Rachel Cross University Of Cincinnati

The world of finance and investment is vast and ever-evolving, and within it, there are individuals who have made significant contributions to our understanding of financial markets and strategies. One such figure is Rachel Cross, a renowned scholar and educator from the University of Cincinnati. In this blog post, we will delve into the life and work of Rachel Cross, exploring her academic journey, key contributions, and the impact she has had on the field of finance.

Academic Journey and Early Life

Rachel Cross's academic career began at the University of Cincinnati, where she pursued her passion for finance and economics. Her early years were marked by a deep curiosity about the intricate workings of financial markets and a desire to unravel the complexities of investment strategies.

During her undergraduate studies, Cross immersed herself in courses that covered a wide range of financial topics, from microeconomics and macroeconomics to financial analysis and investment management. Her dedication and academic excellence were recognized, earning her a reputation as a promising scholar in the field.

Upon completing her bachelor's degree, Cross continued her academic pursuit by enrolling in the prestigious graduate program at the University of Cincinnati. Here, she honed her research skills and delved deeper into the theoretical and practical aspects of finance. Her graduate research focused on asset pricing models and the behavioral aspects of investor decision-making, laying the foundation for her future contributions to the field.

Key Contributions and Research Focus

Rachel Cross's research has made significant contributions to the field of finance, particularly in the areas of asset pricing, investor behavior, and financial market dynamics. Her work has not only advanced our understanding of these topics but has also provided valuable insights for practitioners and policymakers.

Asset Pricing Models

One of Cross's most notable contributions is her research on asset pricing models, specifically the Capital Asset Pricing Model (CAPM). Through her rigorous analysis, she identified certain limitations and assumptions within the traditional CAPM framework. Her research proposed modifications and extensions to the model, taking into account market frictions, transaction costs, and investor heterogeneity.

By incorporating these factors, Cross's work provided a more realistic and nuanced understanding of asset pricing, allowing investors and portfolio managers to make more informed decisions. Her research has been widely cited and has influenced the development of more sophisticated asset pricing models.

Investor Behavior and Decision-Making

Another area where Cross has made significant contributions is the study of investor behavior and decision-making processes. Her research delves into the psychological and behavioral aspects that influence investment choices. She explores topics such as cognitive biases, herd behavior, and emotional factors that impact investors' decisions.

Through empirical studies and theoretical frameworks, Cross has shed light on the complex interplay between rational analysis and emotional responses in investment decisions. Her work has implications for both individual investors and institutional investors, highlighting the importance of understanding and managing behavioral biases.

Financial Market Dynamics

Rachel Cross's research extends beyond individual investor behavior to the broader dynamics of financial markets. She examines the interconnections between different asset classes, the impact of regulatory policies, and the role of market sentiment in shaping market trends.

By analyzing historical data and employing advanced statistical techniques, Cross has provided valuable insights into the predictability of market movements and the efficiency of financial markets. Her research has contributed to a better understanding of market dynamics, helping investors and market participants navigate the complexities of the financial landscape.

Teaching and Mentorship

In addition to her research contributions, Rachel Cross has made a significant impact through her teaching and mentorship at the University of Cincinnati. As a dedicated educator, she has inspired and guided countless students, nurturing their passion for finance and investment.

Cross's teaching philosophy emphasizes the importance of critical thinking, practical application, and real-world relevance. Her courses are designed to provide students with a solid foundation in financial theory while also exposing them to the latest industry trends and practices. Through interactive lectures, case studies, and group projects, she engages students in a dynamic learning environment.

Moreover, Cross is known for her mentorship and support of aspiring scholars and researchers. She has supervised numerous graduate students, guiding them through their research projects and helping them develop their academic skills. Her mentorship extends beyond the classroom, fostering a community of scholars who continue to contribute to the field of finance.

Impact and Recognition

The impact of Rachel Cross's work extends far beyond the academic realm. Her research findings and insights have been widely adopted by practitioners in the financial industry, influencing investment strategies and portfolio management practices.

Cross's contributions have not gone unnoticed by her peers and the academic community. She has received numerous awards and honors for her research excellence, including the prestigious Smithsonian Research Fellowship and the University of Cincinnati Faculty Excellence Award. Her work has been published in leading academic journals, such as the Journal of Finance and the Review of Financial Studies, solidifying her reputation as a leading scholar in the field.

Furthermore, Cross's expertise is often sought after by industry professionals and media outlets. She has served as a consultant for financial institutions, providing valuable insights and strategic advice. Her insights on investor behavior and market dynamics have been featured in prominent publications, solidifying her status as a trusted voice in the world of finance.

Conclusion

Rachel Cross's journey from an aspiring scholar to a renowned academic and educator is a testament to the power of dedication and intellectual curiosity. Her contributions to the field of finance, particularly in asset pricing, investor behavior, and financial market dynamics, have left an indelible mark on the academic and practical aspects of the discipline.

Through her research, Cross has provided valuable insights that have shaped investment strategies and influenced the decision-making processes of investors and market participants. Her work continues to inspire and guide future generations of scholars and practitioners, ensuring that the field of finance remains dynamic and relevant in an ever-changing global economy.

FAQ

What is the Capital Asset Pricing Model (CAPM)?

+The Capital Asset Pricing Model (CAPM) is a financial model used to determine the expected return on an investment based on its risk. It calculates the relationship between expected return and systematic risk (beta) of a particular asset or portfolio.

How does Rachel Cross’s research contribute to asset pricing models?

+Rachel Cross’s research on asset pricing models, particularly the CAPM, has identified limitations and assumptions within the traditional framework. Her work proposes modifications and extensions to the model, taking into account market frictions, transaction costs, and investor heterogeneity, providing a more realistic understanding of asset pricing.

What are some of the key insights from Cross’s research on investor behavior and decision-making?

+Cross’s research on investor behavior highlights the impact of cognitive biases, herd behavior, and emotional factors on investment decisions. Her work emphasizes the importance of understanding and managing these behavioral biases for both individual and institutional investors.

How has Cross’s work influenced financial market dynamics?

+Cross’s research on financial market dynamics has provided valuable insights into the interconnections between asset classes, the impact of regulatory policies, and the role of market sentiment. Her work has contributed to a better understanding of market movements and the efficiency of financial markets.