Maximum Tsp Contribution

Welcome to our comprehensive guide on maximizing your contributions to the Tax-Savings Plan (TSP)! Whether you're a federal employee, uniformed service member, or a participant in the TSP, this guide will help you navigate the ins and outs of this powerful retirement savings tool. By understanding the intricacies of the TSP and implementing strategic contributions, you can make the most of your savings and secure a comfortable retirement.

Understanding the TSP

The Tax-Savings Plan, often referred to as the TSP, is a defined contribution plan sponsored by the federal government. It offers a range of investment options and provides tax advantages to help individuals save for their retirement. With its low fees and diverse investment choices, the TSP has become a popular choice for federal employees and those in the uniformed services.

Maximizing Your TSP Contributions

To make the most of your TSP contributions, it's essential to understand the different types of contributions and the benefits they offer. Here's a breakdown of the key contributions you can make:

1. Regular Contributions

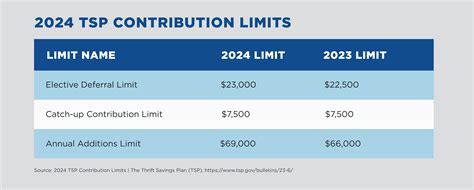

Regular contributions are the foundation of your TSP savings. You can contribute a portion of your pre-tax income to your TSP account, which grows tax-free until you withdraw it during retirement. The maximum regular contribution limit is set annually by the Internal Revenue Service (IRS), so be sure to stay updated on these limits to maximize your savings.

2. Catch-Up Contributions

If you're aged 50 or older, you're eligible for catch-up contributions. These contributions allow you to save even more for retirement by contributing an additional amount on top of your regular contributions. Catch-up contributions provide a great opportunity to boost your retirement savings, especially as you near retirement age.

3. Agency Contributions

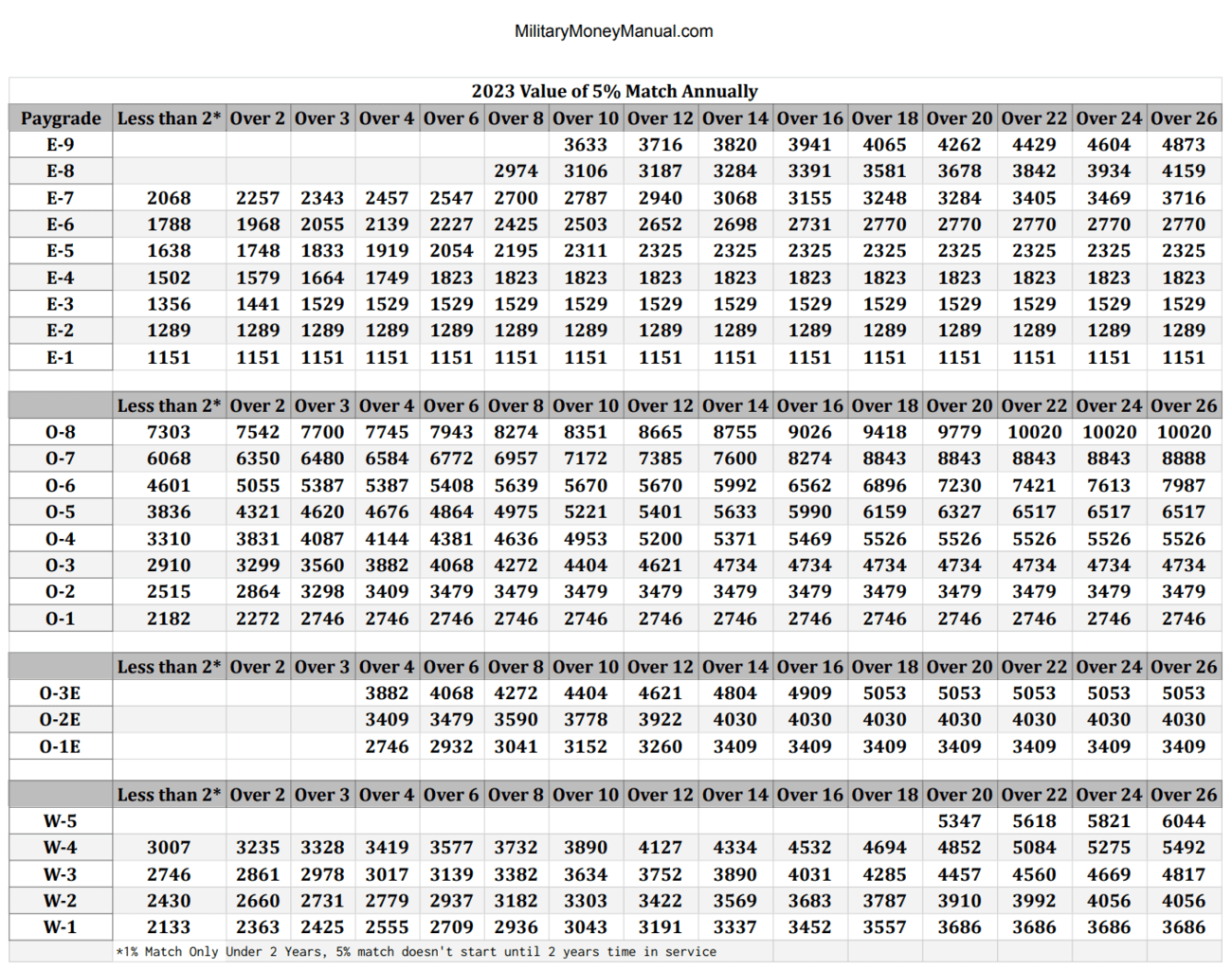

Agency contributions, also known as employer contributions, are a significant benefit of the TSP. Your agency or employer may match a portion of your regular contributions, providing an excellent incentive to save. These contributions are a valuable addition to your retirement savings and should not be overlooked.

Steps to Maximize Your TSP Contributions

Now that we've covered the different types of contributions, let's dive into the steps you can take to maximize your TSP contributions and make the most of this powerful retirement savings tool.

1. Set Clear Goals

Before making any contributions, it's crucial to define your retirement goals. Determine how much you'll need to retire comfortably and set a target for your TSP savings. This will help you stay focused and motivated throughout your savings journey.

2. Understand Your Contribution Limits

Familiarize yourself with the annual contribution limits set by the IRS. Regular contributions have a maximum limit, and it's important to stay within these limits to avoid any penalties. Additionally, be aware of the catch-up contribution limits if you're eligible for them.

3. Take Advantage of Agency Contributions

If your agency or employer offers matching contributions, make sure to contribute enough to maximize this benefit. Agency contributions are essentially free money, and by taking advantage of them, you're accelerating your retirement savings without increasing your taxable income.

4. Automate Your Contributions

Set up automatic contributions from your paycheck to your TSP account. By automating your contributions, you ensure consistent savings without having to remember to make manual contributions each pay period. This disciplined approach will help you reach your savings goals faster.

5. Diversify Your Investments

The TSP offers a range of investment options, including stock and bond funds. Diversifying your investments across different asset classes can help reduce risk and maximize potential returns. Consider your risk tolerance and investment horizon when selecting your investment mix.

6. Stay Informed and Educate Yourself

Stay up-to-date with TSP news, updates, and investment options. The TSP website provides valuable resources and educational materials to help you make informed decisions. By staying informed, you can make adjustments to your investment strategy as needed and ensure your TSP contributions are working hard for your retirement.

Benefits of Maximizing Your TSP Contributions

Maximizing your TSP contributions offers a range of benefits that can significantly impact your retirement savings and overall financial well-being.

1. Tax Advantages

By contributing to your TSP, you enjoy tax advantages that can boost your savings. Regular contributions are made with pre-tax dollars, reducing your taxable income and potentially lowering your tax liability. Additionally, the growth of your TSP investments is tax-deferred, allowing your savings to compound over time without being taxed.

2. Employer Matching Contributions

Agency contributions, or employer matching contributions, are a powerful incentive to maximize your TSP savings. When you contribute to your TSP, your agency may match a portion of your contributions, effectively doubling your savings. This is a significant benefit that can accelerate your retirement savings and provide a comfortable retirement.

3. Retirement Income Security

Maximizing your TSP contributions ensures that you have a substantial retirement savings cushion. By taking advantage of the tax advantages and employer matching contributions, you can build a robust retirement portfolio. This security provides peace of mind and allows you to enjoy your retirement years without financial worries.

4. Flexibility and Control

The TSP offers flexibility and control over your retirement savings. You can choose the investment options that align with your risk tolerance and retirement goals. Additionally, you have the freedom to adjust your contributions as needed, allowing you to make strategic decisions based on your financial situation and life events.

Conclusion: Take Control of Your Retirement Savings

Maximizing your contributions to the Tax-Savings Plan is a strategic approach to securing your financial future. By understanding the different types of contributions, setting clear goals, and taking advantage of tax benefits and employer matching, you can make the most of your TSP savings. Remember to stay informed, diversify your investments, and automate your contributions for a disciplined savings plan. With a well-planned TSP strategy, you can retire with confidence and enjoy a comfortable and secure future.

What is the maximum regular contribution limit for the TSP in 2023?

+The maximum regular contribution limit for the TSP in 2023 is $20,500. This limit is set by the IRS and may be adjusted annually.

Can I make catch-up contributions if I’m not 50 years old yet?

+No, catch-up contributions are only available to participants aged 50 or older. These contributions allow individuals to save beyond the regular contribution limits.

How often should I review and adjust my TSP investments?

+It’s recommended to review your TSP investments at least once a year. This allows you to assess your investment performance, rebalance your portfolio, and make any necessary adjustments based on your financial goals and risk tolerance.

Can I withdraw my TSP contributions before retirement?

+In general, it’s recommended to leave your TSP contributions untouched until retirement. However, there are certain circumstances, such as financial hardship or separation from service, that may allow for early withdrawals. It’s important to understand the rules and potential penalties associated with early withdrawals.

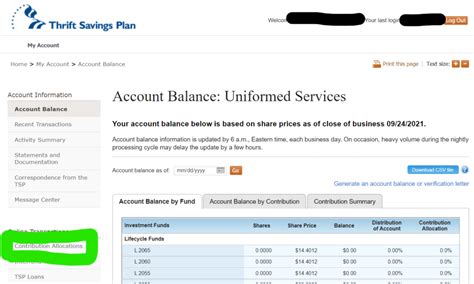

How can I track my TSP contributions and progress?

+You can track your TSP contributions and progress by logging into your TSP account online. The TSP website provides detailed information on your contributions, investment performance, and account balance. Regularly reviewing your TSP account will help you stay on track and make informed decisions.