Key Interest Rates Def

Understanding key interest rates is crucial for navigating the financial landscape and making informed decisions. These rates, set by central banks, have a significant impact on the economy and can influence various aspects of our lives, from borrowing costs to investment opportunities. In this comprehensive guide, we will delve into the world of key interest rates, exploring their definition, role, and implications.

What are Key Interest Rates?

Key interest rates, often referred to as policy rates or benchmark rates, are the interest rates set by central banks to influence the cost of borrowing and lending in an economy. These rates serve as a vital tool for monetary policy and are used to achieve specific economic objectives.

Central banks, such as the Federal Reserve in the United States or the European Central Bank (ECB), play a pivotal role in setting key interest rates. They act as the regulators and overseers of the financial system, aiming to maintain price stability, promote economic growth, and ensure financial stability.

Types of Key Interest Rates

There are several types of key interest rates employed by central banks. Let's explore some of the most common ones:

- Policy Rate - This is the primary interest rate set by central banks. It influences the cost of borrowing for commercial banks and, consequently, affects the overall lending rates in the economy.

- Discount Rate - The discount rate is the interest rate at which central banks lend money to commercial banks. It is often used as a tool to provide liquidity to the financial system during times of stress.

- Reserve Rate (Reserve Requirement) - The reserve rate, also known as the reserve requirement, determines the minimum amount of funds commercial banks must hold as reserves. This rate influences the availability of funds for lending and can impact the money supply.

- Inflation Targeting Rate - Central banks often set an inflation target, and the inflation targeting rate is the interest rate they aim to achieve to maintain price stability. It is a crucial tool for controlling inflation.

The Role of Key Interest Rates

Key interest rates serve multiple purposes and have a profound impact on the economy. Here are some of their key roles:

- Monetary Policy Tool - Central banks use key interest rates as a primary tool for implementing monetary policy. By adjusting these rates, they can influence borrowing costs, stimulate economic growth, or curb inflation.

- Influencing Borrowing Costs - Changes in key interest rates directly impact the cost of borrowing for individuals, businesses, and governments. Lower rates encourage borrowing, while higher rates discourage it.

- Managing Inflation - One of the primary objectives of central banks is to maintain price stability. Key interest rates play a crucial role in controlling inflation by influencing the money supply and borrowing costs.

- Economic Growth Stimulation - During economic downturns, central banks may lower key interest rates to encourage borrowing and investment. This can help boost economic growth and stimulate the economy.

- Financial Stability - Key interest rates also contribute to financial stability. By adjusting rates, central banks can influence the availability of credit, manage liquidity, and prevent excessive risk-taking in the financial system.

Implications for Individuals and Businesses

The decisions made by central banks regarding key interest rates have far-reaching implications for individuals and businesses. Let's explore how these rates affect different aspects:

Borrowing and Lending

Changes in key interest rates directly impact the cost of borrowing. When rates are low, it becomes more affordable to take out loans for personal or business purposes. On the other hand, higher rates can make borrowing more expensive, affecting investment decisions.

Savings and Investments

Key interest rates also influence savings and investment opportunities. When rates are high, individuals may prefer to save their money in interest-bearing accounts rather than spending or investing. Conversely, lower rates may encourage riskier investments in search of higher returns.

Housing Market

The housing market is particularly sensitive to changes in key interest rates. Lower rates often lead to increased demand for mortgages, as borrowing becomes more affordable. This can drive up housing prices and impact the overall real estate market.

Business Operations

Businesses rely on borrowing to fund their operations and expansion. Key interest rates affect the cost of capital, influencing investment decisions and the overall business environment. Lower rates can stimulate business growth, while higher rates may lead to cautious spending.

How Central Banks Set Key Interest Rates

Central banks employ various factors and indicators to determine the appropriate key interest rates. Here are some key considerations:

- Economic Conditions - Central banks closely monitor economic indicators such as GDP growth, unemployment rates, and inflation. These factors help assess the overall health of the economy and guide interest rate decisions.

- Inflation Targets - Central banks typically have an inflation target, which is a specific rate of inflation they aim to achieve. They adjust key interest rates to keep inflation within this target range.

- Market Expectations - Central banks consider market expectations and investor sentiment. By signaling their intentions and providing guidance, they can influence market behavior and manage expectations.

- Financial Stability Risks - Central banks also assess financial stability risks. They may raise interest rates to curb excessive risk-taking or lower them to provide support during economic downturns.

Impact on Exchange Rates

Key interest rates also have a significant impact on exchange rates. When a country's central bank raises interest rates, it often attracts foreign investment, leading to an increase in demand for the country's currency. This, in turn, can strengthen the currency's value relative to other currencies.

Conversely, when interest rates are lowered, it may lead to a decrease in foreign investment, causing the currency to weaken. Exchange rate fluctuations can have a substantial impact on international trade, imports, and exports, affecting the overall economy.

Historical Perspective

Throughout history, key interest rates have played a crucial role in shaping economic cycles and market trends. Let's take a brief look at some notable periods:

- The Great Depression - During the 1930s, central banks struggled to respond effectively to the economic crisis. High interest rates and tight monetary policy contributed to the severity of the depression.

- Post-World War II Boom - In the post-war period, central banks adopted expansionary monetary policies, leading to low interest rates and a period of economic growth and prosperity.

- The 2008 Financial Crisis - In response to the global financial crisis, central banks around the world lowered interest rates to stimulate borrowing and investment. This helped mitigate the impact of the crisis and supported economic recovery.

The Future of Key Interest Rates

As the global economy continues to evolve, central banks face new challenges and opportunities. Here are some trends and considerations for the future of key interest rates:

- Digital Currencies and Central Bank Digital Currencies (CBDCs) - The rise of digital currencies and CBDCs may impact the role of key interest rates. Central banks will need to adapt their policies to accommodate these new forms of currency.

- Climate Change and Sustainability - Central banks are increasingly recognizing the impact of climate change on the economy. They may incorporate sustainability considerations into their monetary policy decisions, potentially influencing key interest rates.

- Technological Advancements - Advances in technology, such as artificial intelligence and machine learning, may enhance central banks' ability to analyze economic data and make more informed interest rate decisions.

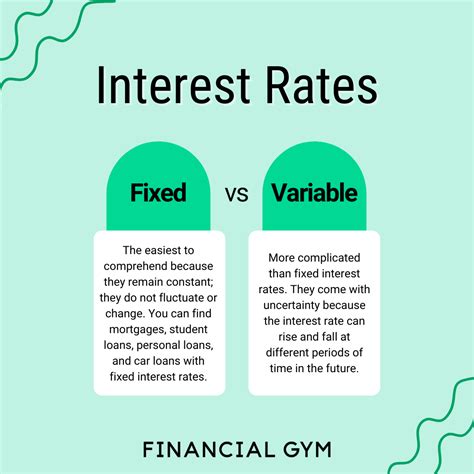

Key Interest Rates vs. Other Interest Rates

It's important to distinguish key interest rates from other types of interest rates in the financial system. Here are some key differences:

- Market Interest Rates - Market interest rates, such as those for mortgages or corporate bonds, are determined by supply and demand in the market. They are influenced by key interest rates but are not directly set by central banks.

- Interbank Lending Rates - Interbank lending rates, like the London Interbank Offered Rate (LIBOR), represent the interest rates at which banks lend to each other. These rates are influenced by key interest rates but are determined by market forces.

FAQs

How often do central banks adjust key interest rates?

+Central banks typically announce their interest rate decisions at regular intervals, often quarterly or monthly. However, in exceptional circumstances, they may make unscheduled adjustments.

What happens if key interest rates are too low for an extended period?

+Prolonged low interest rates can lead to excessive risk-taking, asset bubbles, and potential financial instability. Central banks must carefully manage the timing and pace of rate adjustments to avoid such risks.

How do key interest rates impact the stock market?

+Changes in key interest rates can influence stock market performance. Lower rates often boost investor confidence and encourage riskier investments, leading to higher stock prices. Conversely, higher rates may cause a decline in stock prices.

Can central banks influence long-term interest rates?

+Central banks primarily focus on short-term interest rates, but their actions can have an indirect impact on long-term rates. Market expectations and investor sentiment play a significant role in determining long-term interest rates.

Conclusion

Key interest rates are a powerful tool in the hands of central banks, allowing them to shape the economy and promote financial stability. Understanding these rates and their implications is essential for individuals, businesses, and investors alike. By staying informed about key interest rates and their potential impact, we can make more informed financial decisions and navigate the ever-changing economic landscape.