Essential Steps For $50,000 Salary To Hourly Conversion: Your Hourly Pay, Decoded

Decoding Your Salary: Unraveling the $50,000 Annual Income into Hourly Pay

Converting a salary into an hourly rate is a crucial step in understanding your earnings and ensuring fair compensation for your work. If you’re earning an annual salary of $50,000, you might be curious about how that translates into an hourly wage. In this guide, we will walk you through the essential steps to calculate your hourly pay, providing you with a clear understanding of your earnings.

Step 1: Understanding the Basics

Before we dive into the calculations, let’s establish some key terms:

- Salary: This is the fixed amount you earn annually, typically paid in regular intervals such as weekly, biweekly, or monthly.

- Hourly Rate: Your hourly pay represents the amount you earn for each hour worked. It is calculated by dividing your annual salary by the number of hours worked in a year.

- Hours Worked: The total number of hours you work in a year, including overtime, is an essential factor in determining your hourly rate.

Step 2: Calculating Your Hourly Rate

To convert your $50,000 annual salary into an hourly rate, follow these simple steps:

Determine the number of hours you work in a year. This will depend on your work schedule and any overtime hours. Let’s assume you work a standard 40-hour workweek and take into account 2 weeks of paid vacation and 10 national holidays, resulting in a total of 2,080 hours worked per year.

Divide your annual salary by the number of hours worked:

- Hourly Rate = Annual Salary / Hours Worked

- Hourly Rate = $50,000 / 2,080 hours

- Hourly Rate ≈ $24.04

So, with a 50,000 annual salary and a standard work schedule, your hourly rate would be approximately 24.04.

Step 3: Overtime and Additional Factors

It’s important to note that the above calculation assumes a standard work schedule without overtime. If you regularly work overtime or have a variable work schedule, your hourly rate may differ. Here are some additional factors to consider:

- Overtime: If you work overtime, your hourly rate for those hours may be higher. Many countries have laws that require employers to pay overtime rates, which are typically 1.5 times the regular hourly rate.

- Benefits and Deductions: When calculating your take-home pay, remember to consider any benefits or deductions that may affect your net income. These could include taxes, insurance premiums, retirement contributions, or other payroll deductions.

Step 4: Adjusting for Different Work Schedules

The calculation provided assumes a standard 40-hour workweek. If your work schedule varies, you can adjust the calculation accordingly:

- Part-Time Work: If you work part-time, you can still calculate your hourly rate by dividing your annual salary by the number of hours worked. However, keep in mind that your hourly rate may be higher due to the reduced number of hours worked.

- Flexible Hours: Some jobs offer flexible hours or the ability to work remotely. In such cases, you can calculate your hourly rate based on the actual hours you work, ensuring an accurate representation of your earnings.

Step 5: Understanding the Impact on Your Earnings

Knowing your hourly rate is essential for various reasons:

- Comparing Opportunities: When considering job offers or negotiating salaries, understanding your hourly rate allows you to compare different positions and ensure you are fairly compensated for your skills and experience.

- Budgeting and Financial Planning: Having a clear understanding of your hourly pay helps you budget effectively and plan for your financial goals. It allows you to estimate your take-home pay and make informed decisions about your spending and savings.

- Freelancing and Self-Employment: If you are a freelancer or self-employed, calculating your hourly rate is crucial for setting your fees and ensuring you charge adequately for your services.

Notes:

🧮 Note: The calculation provided is a general guideline. Actual hourly rates may vary based on individual circumstances, such as overtime, benefits, and deductions.

⏰ Note: Remember to consider the number of hours worked in a year accurately. This calculation assumes a standard work schedule, but adjustments can be made for variable schedules.

💰 Note: Your take-home pay may differ from your gross hourly rate due to taxes and other deductions. Ensure you understand your payroll deductions to estimate your net income accurately.

Conclusion:

Understanding your hourly pay is a vital step in managing your finances and ensuring fair compensation. By converting your $50,000 annual salary into an hourly rate, you gain valuable insights into your earnings and can make informed decisions about your career and financial goals. Remember to consider any additional factors, such as overtime and benefits, to get a comprehensive view of your income.

FAQ

How does overtime affect my hourly rate calculation?

+Overtime hours are typically paid at a higher rate, often 1.5 times your regular hourly rate. When calculating your hourly rate, ensure you consider any overtime pay to get an accurate representation of your earnings.

Can I negotiate my hourly rate if I work part-time or have a flexible schedule?

+Yes, negotiating your hourly rate is possible, especially if you have specialized skills or offer unique value to the company. Discuss your contribution and the market rate for your skills to justify a higher hourly rate.

What if I work in a country with a different standard workweek than the one mentioned in the guide?

+The calculation provided is a general guideline. Adjust the number of hours worked to match your country’s standard workweek or your specific work schedule to get an accurate hourly rate calculation.

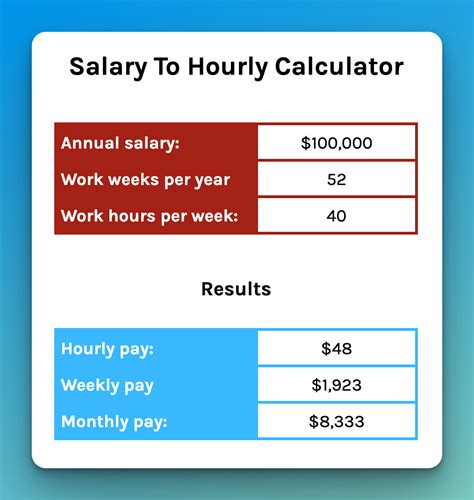

Are there any online tools or calculators that can help me with the conversion?

+Yes, there are several online salary and hourly rate calculators available. These tools can simplify the calculation process and provide instant results based on your input. However, always double-check the calculations to ensure accuracy.

How often should I review and update my hourly rate calculation?

+It’s a good practice to review your hourly rate calculation annually or whenever there are significant changes in your work schedule or salary. This ensures that your understanding of your earnings remains up-to-date.