Bragg Mutual Credit Union

Bragg Mutual Credit Union is a financial institution that offers a range of services to its members, providing them with access to various financial products and support. With a focus on community and member satisfaction, Bragg Mutual has become a trusted name in the financial sector. In this blog post, we will delve into the world of Bragg Mutual Credit Union, exploring its history, services, and the benefits it brings to its members.

A Brief History

Bragg Mutual Credit Union has its roots deeply embedded in the local community. Established in [Year], it was founded with the vision of creating a financial cooperative that would serve the unique needs of the community. The credit union's journey began with a small group of dedicated individuals who believed in the power of mutual support and financial empowerment.

Over the years, Bragg Mutual has grown and expanded its reach, becoming a prominent player in the financial industry. It has consistently adapted to the changing landscape, offering innovative solutions and staying true to its core values of integrity, transparency, and member satisfaction.

Services Offered

Bragg Mutual Credit Union provides a comprehensive range of financial services to cater to the diverse needs of its members. Here's an overview of some of the key services they offer:

Savings Accounts

- Regular Savings Accounts: Members can open basic savings accounts with competitive interest rates, allowing them to grow their savings over time.

- High-Yield Savings Accounts: For those seeking higher returns, Bragg Mutual offers accounts with enhanced interest rates, perfect for long-term savings goals.

- Youth Savings Accounts: Encouraging financial literacy from a young age, the credit union provides special savings accounts for children and teenagers.

Checking Accounts

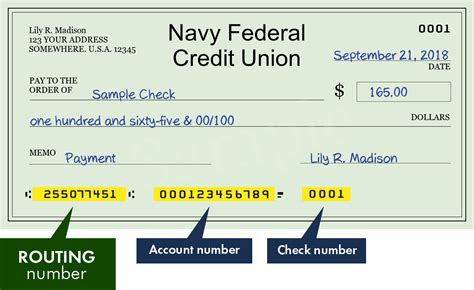

- Free Checking Accounts: Bragg Mutual offers no-fee checking accounts with convenient features like online banking, mobile check deposit, and ATM access.

- Business Checking Accounts: Tailored for small businesses, these accounts provide essential banking services with added benefits like merchant services and payroll processing.

Loans and Mortgages

- Personal Loans: Members can apply for loans to cover various expenses, such as home improvements, debt consolidation, or special occasions.

- Auto Loans: Competitive rates and flexible terms make it easier for members to finance their vehicle purchases.

- Mortgages: Bragg Mutual offers a range of mortgage options, including fixed-rate and adjustable-rate mortgages, helping members achieve their homeownership dreams.

Credit Cards

Bragg Mutual provides a selection of credit cards with rewards and benefits, allowing members to earn points, cashback, or travel miles with their purchases.

Investment Services

For those looking to grow their wealth, the credit union offers investment services, including:

- Investment Accounts: Members can invest in a variety of assets, such as stocks, bonds, and mutual funds, to build their portfolios.

- Retirement Planning: Expert guidance is provided to help members plan for their retirement, ensuring a secure financial future.

Online and Mobile Banking

Bragg Mutual understands the importance of convenience and accessibility. Their online and mobile banking platforms offer:

- 24/7 Account Access: Members can manage their finances, transfer funds, and pay bills anytime, from anywhere.

- Mobile Check Deposit: Deposit checks directly from their mobile devices, saving time and trips to the branch.

- Secure Messaging: A direct line of communication with the credit union's support team for quick inquiries and assistance.

Benefits of Being a Member

Choosing Bragg Mutual Credit Union comes with a host of advantages. Here are some key benefits that members enjoy:

Competitive Rates

Bragg Mutual prides itself on offering competitive interest rates on savings accounts and loans, ensuring members get the most out of their financial decisions.

Personalized Service

As a member-owned cooperative, Bragg Mutual prioritizes personalized service. Members receive dedicated attention and tailored financial solutions to meet their unique needs.

Lower Fees

Compared to traditional banks, credit unions often have lower fees and fewer hidden charges. Bragg Mutual strives to keep fees transparent and affordable, making banking more accessible to its members.

Community Involvement

Bragg Mutual is deeply rooted in the community it serves. The credit union actively participates in local events, supports charitable causes, and promotes financial education, fostering a sense of belonging among its members.

Financial Education

Empowering its members with financial knowledge is a core principle of Bragg Mutual. They offer educational resources, workshops, and seminars to help members make informed financial decisions and achieve their goals.

How to Become a Member

Joining Bragg Mutual Credit Union is simple and open to individuals who meet the eligibility criteria. Here's a step-by-step guide to becoming a member:

- Eligibility: Check if you are eligible to join. Typically, eligibility is based on residence, employment, or membership in a specific organization or community group.

- Application: Fill out a membership application form, providing your personal details and choosing the share account that suits your needs.

- Initial Deposit: Make an initial deposit into your share account to become a member-owner of the credit union.

- Verification: The credit union will verify your information and process your application. Once approved, you'll receive a membership number and can start enjoying the benefits.

FAQs

Can anyone join Bragg Mutual Credit Union?

+While membership eligibility varies, Bragg Mutual typically extends membership to individuals living or working within a certain geographic area or those associated with specific organizations or community groups.

What are the benefits of becoming a member of a credit union like Bragg Mutual?

+Members enjoy competitive rates, personalized service, lower fees, and a sense of community involvement. Bragg Mutual also provides financial education resources to empower its members.

How can I open an account with Bragg Mutual Credit Union?

+You can visit their website or physical branch to start the membership process. Provide the required information and make an initial deposit to become a member.

Does Bragg Mutual offer online and mobile banking services?

+Yes, Bragg Mutual provides convenient online and mobile banking platforms, allowing members to manage their accounts, transfer funds, and access other services 24/7.

Final Thoughts

Bragg Mutual Credit Union stands as a testament to the power of community-focused financial institutions. With a rich history, a diverse range of services, and a commitment to member satisfaction, it has become a trusted partner for individuals and businesses alike. By joining Bragg Mutual, members not only gain access to competitive financial products but also become part of a supportive community that values their well-being and financial success.

Whether you’re looking to save, invest, or borrow, Bragg Mutual Credit Union offers a personalized and transparent approach to banking. Their dedication to financial education and community involvement sets them apart, making them a preferred choice for those seeking a financial institution that cares.