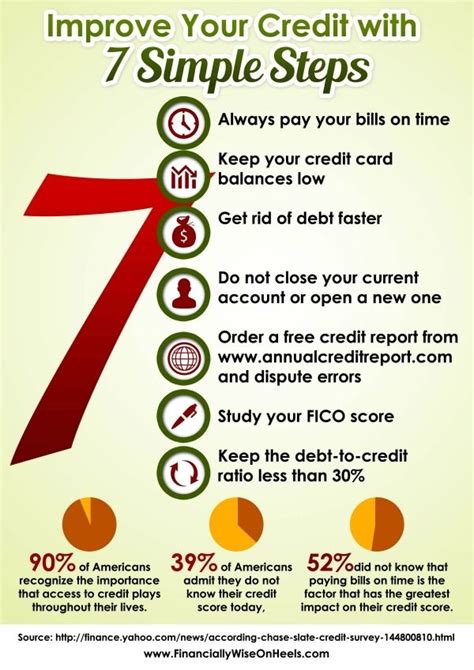

7 Ways To Make Your Credit Score Perfect Today

Understanding Credit Scores

Your credit score is a crucial aspect of your financial health and can impact various aspects of your life, from securing loans to renting an apartment. A good credit score opens doors to better financial opportunities, while a poor score can create obstacles. In this blog post, we will explore seven effective strategies to boost your credit score and help you achieve financial success.

1. Check Your Credit Report Regularly

The first step towards improving your credit score is to obtain and review your credit report. Your credit report contains detailed information about your financial history, including loans, credit cards, and payment records. By regularly checking your report, you can identify any errors, discrepancies, or signs of identity theft.

Requesting Your Credit Report:

- Contact Credit Bureaus: In many countries, you have the right to request a free credit report from credit bureaus such as Equifax, Experian, or TransUnion. These reports provide a comprehensive overview of your credit history.

- Online Requests: Most credit bureaus offer online platforms where you can create an account and access your credit report digitally. This method is convenient and allows for quick updates.

- Mail or Phone: If you prefer traditional methods, you can request your credit report via mail or phone. Contact the credit bureaus directly to inquire about their specific procedures.

Analyzing Your Credit Report:

- Identify Errors: Carefully examine your credit report for any inaccuracies. This includes incorrect personal information, accounts you didn’t open, or late payments that are falsely recorded.

- Dispute Inaccuracies: If you find errors, dispute them with the credit bureau and provide supporting evidence. This process can help remove negative marks from your report and improve your credit score.

- Monitor Progress: Regularly checking your credit report allows you to track your progress and identify areas that need improvement. It also helps you stay informed about any changes in your credit profile.

2. Pay Your Bills on Time

Timely bill payments are one of the most critical factors in determining your credit score. Lenders and creditors look favorably upon individuals who consistently pay their bills on time. Here’s how you can ensure timely payments:

Setting Up Payment Reminders:

- Online Banking: Utilize online banking platforms offered by your financial institutions. Set up payment reminders or automatic payments to ensure you never miss a due date.

- Calendar Alerts: Create calendar events or set reminders on your phone for bill payment due dates. This simple step can help you stay organized and avoid late fees.

- Direct Debit: Consider setting up direct debit for recurring payments, such as rent, mortgage, or utility bills. This automated process ensures that payments are made promptly.

Understanding Grace Periods:

- Grace Period Awareness: Be aware of the grace periods allowed by your creditors. Grace periods are the time between the due date and the date when late fees are applied. Make sure to pay within this period to avoid penalties.

- Late Payment Consequences: Late payments can have severe consequences on your credit score. They may remain on your report for up to seven years, impacting your ability to access credit in the future.

3. Reduce Your Credit Utilization

Your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit limit, plays a significant role in your credit score. Lenders prefer borrowers who use a small portion of their available credit. Here’s how to optimize your credit utilization:

Calculating Credit Utilization:

- Total Credit Limit: Add up the credit limits of all your credit cards and other revolving credit accounts. This is your total available credit.

- Current Balances: Sum up the current balances on all your credit accounts. This represents the amount of credit you’re currently utilizing.

- Utilization Ratio: Divide your current balances by your total credit limit. The resulting percentage is your credit utilization ratio.

Strategies to Reduce Utilization:

- Pay Down Balances: If you have high credit card balances, focus on paying them down. Aim to keep your utilization ratio below 30% for the best credit score impact.

- Increase Credit Limits: Contact your credit card issuers and request an increase in your credit limits. This can lower your utilization ratio without requiring you to pay off more debt.

- Utilize Multiple Cards: If you have multiple credit cards, distribute your spending across them to keep individual card balances low. This strategy can help improve your overall utilization ratio.

4. Build a Positive Payment History

A solid payment history is essential for maintaining a good credit score. Lenders want to see a consistent pattern of on-time payments over an extended period. Here’s how you can build a positive payment history:

Establishing a Payment Routine:

- Create a Budget: Develop a monthly budget that accounts for all your expenses, including bills and credit card payments. This budget will help you allocate funds effectively and ensure timely payments.

- Automate Payments: Consider setting up automatic payments for your credit cards and loans. This way, you won’t have to worry about forgetting due dates, and your payments will always be on time.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum required amount on your credit cards. This demonstrates financial responsibility and can help improve your credit score.

Maintaining Consistency:

- Avoid Missed Payments: Missing even a single payment can have a negative impact on your credit score. Stay disciplined and prioritize your financial obligations.

- Set Up Payment Reminders: Use calendar alerts or reminder apps to ensure you never forget a payment. Consistency is key to building a strong payment history.

- Long-Term Perspective: Building a positive payment history takes time. Focus on maintaining consistent on-time payments over an extended period to see significant improvements in your credit score.

5. Diversify Your Credit Portfolio

Having a diverse range of credit accounts can positively impact your credit score. Lenders prefer to see that you can manage different types of credit responsibly. Here’s how you can diversify your credit portfolio:

Types of Credit:

- Revolving Credit: This includes credit cards and lines of credit, where you have a set credit limit and can borrow and repay as needed.

- Installment Credit: Examples include personal loans, auto loans, and mortgages. These loans have fixed repayment terms and regular payments.

- Open-Ended Credit: Store cards or home equity lines of credit fall under this category, offering ongoing credit access with varying repayment terms.

Strategies for Diversification:

- Open New Accounts: If you have primarily revolving credit, consider opening an installment loan or a store card to diversify your portfolio. However, be cautious not to overextend yourself.

- Maintain a Mix: Aim to have a mix of credit types in your portfolio. This demonstrates your ability to manage different financial obligations effectively.

- Avoid Closing Old Accounts: Closing old credit accounts can negatively impact your credit score, especially if they have a long history of on-time payments. Keep them open and use them responsibly.

6. Monitor Your Credit Utilization Across Accounts

While focusing on your overall credit utilization is essential, it’s also crucial to monitor your utilization across individual accounts. High utilization on a single credit card can negatively impact your score, even if your overall utilization is low.

Strategies for Balanced Utilization:

- Spread Out Spending: Distribute your spending across multiple credit cards to keep individual card utilization low. This strategy can help improve your overall credit score.

- Avoid Maxing Out Cards: Try to keep your credit card balances well below the credit limit. Maxing out your cards can signal financial stress and hurt your creditworthiness.

- Monitor Utilization Ratios: Regularly check your credit utilization ratios for each credit card. Aim to keep them below 30% to maintain a healthy credit profile.

7. Consider Credit-Builder Programs

If you’re starting with a limited or non-existent credit history, credit-builder programs can be an excellent way to establish a positive credit profile. These programs are designed to help individuals with little to no credit build a solid foundation.

How Credit-Builder Programs Work:

- Secured Credit Cards: These cards require a security deposit, which serves as your credit limit. As you make on-time payments, the card issuer reports your positive payment history to the credit bureaus, helping you build credit.

- Credit-Builder Loans: These loans are specifically designed to help individuals with poor or no credit. You make regular payments over a set period, and the lender reports your payment history to the credit bureaus.

- Rent-to-Own Programs: Some companies offer rent-to-own programs, where you can rent an item with the option to purchase it later. These programs can help establish a positive payment history and improve your credit score.

Notes:

💡 Note: Building a strong credit score takes time and consistency. Be patient and continue to practice responsible financial habits. The strategies outlined above will help you improve your creditworthiness over time.

Conclusion:

Improving your credit score is a journey that requires discipline and a commitment to responsible financial practices. By regularly checking your credit report, paying your bills on time, reducing credit utilization, building a positive payment history, diversifying your credit portfolio, and considering credit-builder programs, you can take control of your financial future. Remember, a good credit score opens doors to better financial opportunities, so start implementing these strategies today!

FAQ:

How often should I check my credit report?

+It’s recommended to check your credit report at least once a year. This allows you to stay informed about any changes and quickly identify any errors or fraudulent activities.

Can I dispute credit report errors online?

+Yes, most credit bureaus provide online platforms where you can dispute inaccuracies in your credit report. Gather supporting documentation and follow the instructions provided by the credit bureau.

How long do late payments stay on my credit report?

+Late payments can remain on your credit report for up to seven years. However, the impact of late payments diminishes over time, so focusing on timely payments moving forward is crucial.

Is it better to close a credit card or keep it open?

+In most cases, it’s better to keep a credit card open, especially if you have a long history of on-time payments. Closing a credit card can shorten your credit history and potentially impact your credit score negatively.

Can I improve my credit score quickly?

+Improving your credit score takes time and consistent effort. While certain strategies can provide a quick boost, long-term improvements require discipline and responsible financial habits. Focus on the strategies outlined in this blog post for sustainable results.