7 Expert Tips To Create A Perfect Wsu Tuition Strategy Now

Introduction

Creating a comprehensive tuition strategy is crucial for students planning to attend Washington State University (WSU). With the rising costs of education, it is essential to have a well-thought-out plan to manage your finances effectively. In this blog post, we will explore seven expert tips to help you create a perfect WSU tuition strategy, ensuring a smooth and stress-free academic journey. By following these tips, you can make informed decisions and take control of your financial future.

Tip 1: Understand Your Financial Aid Options

Exploring and understanding the various financial aid options available is the first step toward creating a solid tuition strategy. WSU offers a range of financial assistance programs to support students in meeting their educational expenses. Here are some key financial aid options to consider:

Scholarships: WSU provides numerous scholarships specifically designed for incoming students. These scholarships can significantly reduce your tuition costs. Research and apply for scholarships that align with your academic achievements, extracurricular involvement, or specific interests.

Grants: Unlike loans, grants do not need to be repaid. WSU offers various grant programs based on financial need, academic merit, or specific criteria. Explore grants such as the Federal Pell Grant, Washington State Need Grant, or institutional grants offered by WSU.

Loans: Student loans can be a viable option to cover tuition and other educational expenses. WSU participates in the Federal Direct Loan Program, offering both subsidized and unsubsidized loans. Consider the terms and conditions of these loans, including interest rates and repayment plans, to make an informed decision.

Work-Study Programs: The Federal Work-Study program provides part-time job opportunities for students with financial need. These jobs not only help cover educational expenses but also offer valuable work experience. Check if you are eligible for work-study and explore the available positions on campus.

External Scholarships and Grants: Besides WSU-specific scholarships, explore external scholarship opportunities offered by private organizations, foundations, or community groups. These scholarships can provide additional financial support and reduce your overall tuition burden.

Tip 2: Create a Budget and Stick to It

Developing a realistic budget is essential to managing your finances effectively. Here’s a step-by-step guide to creating a budget for your WSU tuition strategy:

Estimate Total Costs: Begin by calculating the total estimated costs for your entire academic journey at WSU. This includes tuition fees, accommodation, books and supplies, transportation, and personal expenses. Use WSU’s cost estimators or consult with the financial aid office to get accurate estimates.

Identify Income Sources: Determine your expected income sources. This may include financial aid, scholarships, grants, loans, savings, or contributions from family members. Calculate the total income you can expect to receive each semester or academic year.

Prioritize Expenses: Categorize your expenses into essential and non-essential categories. Essential expenses include tuition fees, accommodation, and basic living costs. Non-essential expenses might include entertainment, dining out, or travel. Prioritize essential expenses and allocate funds accordingly.

Allocate Funds: Based on your income and estimated costs, allocate funds to each expense category. Ensure you have sufficient funds for essential expenses and try to minimize non-essential spending. Consider using budgeting apps or spreadsheets to track your income and expenses regularly.

Monitor and Adjust: Regularly review your budget and track your spending. Compare your actual expenses with your budgeted amounts. If you notice any discrepancies or unexpected costs, make adjustments to your budget accordingly. Stay disciplined and stick to your budget to avoid financial strain.

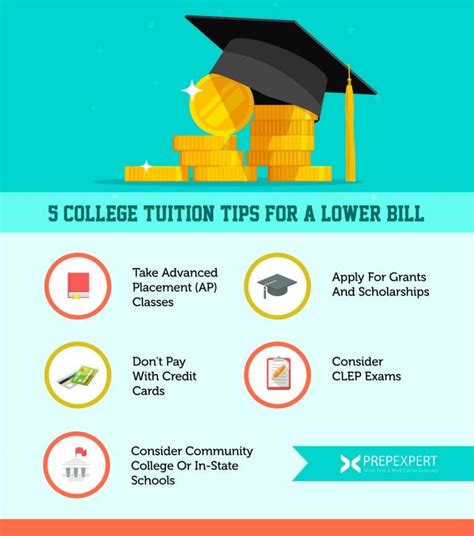

Tip 3: Explore Cost-Saving Strategies

Implementing cost-saving strategies can significantly reduce your overall tuition expenses. Here are some effective strategies to consider:

Scholarship Search Engines: Utilize scholarship search engines and databases to find external scholarships that match your qualifications and interests. Websites like Fastweb, Scholarships.com, and Niche offer comprehensive scholarship listings, making it easier to identify potential opportunities.

Community College Transfer: Consider attending a community college for your first year or two and then transferring to WSU. Community colleges often offer lower tuition rates, allowing you to save money while completing your general education requirements. Ensure that the credits you earn are transferable to WSU to maximize cost savings.

Tuition Payment Plans: WSU offers tuition payment plans that allow you to spread out your tuition payments over multiple installments. This can help ease the financial burden by breaking down the total cost into smaller, more manageable payments. Explore the payment plan options and choose the one that best suits your financial situation.

Work Part-Time: Working part-time during your studies can provide additional income to cover expenses. Look for on-campus jobs, such as research assistantships, tutoring positions, or work-study opportunities. These jobs not only offer financial benefits but also valuable work experience and networking opportunities.

Live Off-Campus: While living on campus can be convenient, it often comes with higher costs. Consider living off-campus, either in an apartment or with roommates, to reduce accommodation expenses. Compare rental prices and explore different housing options to find the most cost-effective solution.

Tip 4: Maximize Financial Aid Eligibility

To maximize your financial aid eligibility, it is crucial to understand the factors that influence aid awards. Here are some strategies to enhance your chances of receiving financial aid:

Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is a crucial step in determining your eligibility for federal financial aid. Fill out the FAFSA accurately and on time to ensure you are considered for grants, loans, and work-study programs. The FAFSA considers your family’s financial information, so gather the necessary documents and complete the application promptly.

Maintain Good Academic Standing: Financial aid eligibility is often tied to academic performance. Maintain a strong grade point average (GPA) and stay in good academic standing to continue receiving financial aid. Many scholarships and grants have specific GPA requirements, so focus on your studies and strive for academic excellence.

Submit Required Documents: Financial aid offices may require additional documentation to process your application. Be prompt in submitting any requested documents, such as tax returns, income verification forms, or other supporting materials. Timely submission ensures a smooth financial aid process and avoids delays in receiving your aid package.

Renew Financial Aid Each Year: Financial aid is typically awarded on an annual basis. Remember to renew your financial aid application every year to maintain your eligibility. Update your FAFSA information and provide any required documentation to ensure continued support throughout your academic journey.

Tip 5: Utilize Campus Resources

WSU provides various resources and support services to assist students with their financial planning and well-being. Take advantage of these resources to optimize your tuition strategy:

Financial Aid Office: The WSU Financial Aid Office is your go-to resource for financial aid-related inquiries. Schedule appointments with financial aid counselors who can provide personalized advice and guidance. They can help you understand your aid package, explain eligibility requirements, and offer strategies to maximize your financial aid benefits.

Scholarship Databases: WSU maintains scholarship databases that list various scholarship opportunities available to students. Explore these databases regularly to identify scholarships that match your qualifications and interests. Stay updated on application deadlines and requirements to increase your chances of receiving scholarship awards.

Student Employment Services: WSU’s Student Employment Services office can assist you in finding on-campus jobs or internships. They can help you connect with employers, provide resume and interview preparation support, and offer guidance on balancing work and studies. Consider exploring part-time employment opportunities to supplement your income and gain valuable work experience.

Student Support Services: WSU offers a range of student support services, including academic advising, career counseling, and mental health services. These services can help you navigate your academic journey, make informed career choices, and manage any personal challenges that may impact your financial situation. Take advantage of these resources to enhance your overall well-being and academic success.

Tip 6: Stay Informed and Ask for Help

Staying informed about financial aid policies, deadlines, and changes is essential to making the most of your tuition strategy. Here’s how you can stay updated and seek assistance:

Subscribe to Financial Aid Updates: Sign up for financial aid newsletters or follow WSU’s financial aid office on social media platforms. This will ensure you receive timely updates on important deadlines, new scholarship opportunities, and any changes to financial aid policies.

Attend Financial Aid Workshops: WSU often organizes financial aid workshops and information sessions throughout the year. Attend these events to gain valuable insights, ask questions, and connect with financial aid experts. These workshops can provide practical tips and strategies to optimize your financial aid journey.

Utilize Online Resources: Explore WSU’s financial aid website and online resources. These platforms often provide comprehensive information about financial aid programs, scholarship opportunities, and important deadlines. Take advantage of online calculators, budget planners, and financial literacy resources to enhance your financial knowledge and decision-making.

Seek Professional Advice: If you have complex financial circumstances or need personalized guidance, consider seeking professional advice from a financial planner or advisor. They can provide expert insights and tailor a financial plan to your specific needs and goals. Remember, it’s important to find a trusted and qualified professional who specializes in education finance.

Tip 7: Plan for the Future and Stay Motivated

Creating a tuition strategy is an ongoing process that requires planning and motivation. Here are some tips to help you stay focused and on track:

Set Short-Term and Long-Term Goals: Break down your financial goals into short-term and long-term milestones. For example, a short-term goal could be to secure a part-time job to cover your living expenses, while a long-term goal might be to graduate debt-free. Setting clear goals will keep you motivated and provide a sense of direction.

Visualize Your Future: Take time to envision your future after completing your studies at WSU. Imagine the career opportunities, personal growth, and achievements you aspire to attain. This visualization can serve as a powerful motivator to stay committed to your financial goals and make smart financial decisions.

Celebrate Milestones: Acknowledge and celebrate your progress along the way. Whether it’s receiving a scholarship award, paying off a loan installment, or achieving a significant milestone in your studies, celebrate these accomplishments. Recognizing your achievements will boost your confidence and motivate you to continue striving for financial success.

Stay Organized: Maintain a well-organized system for your financial documents, records, and important dates. Use digital tools or physical folders to keep track of your financial aid applications, scholarship deadlines, and budget plans. Staying organized will help you stay on top of your finances and make informed decisions.

Conclusion

Creating a perfect WSU tuition strategy requires careful planning, research, and a proactive approach. By understanding your financial aid options, creating a budget, exploring cost-saving strategies, maximizing financial aid eligibility, utilizing campus resources, staying informed, and planning for the future, you can take control of your financial journey. Remember, financial planning is an ongoing process, and seeking support from financial aid professionals and campus resources can greatly benefit your overall success. With a well-thought-out tuition strategy, you can focus on your academic pursuits and achieve your goals at WSU.

FAQ

What is the Free Application for Federal Student Aid (FAFSA)?

+The Free Application for Federal Student Aid (FAFSA) is a form that students in the United States must complete to determine their eligibility for federal financial aid, including grants, loans, and work-study programs. It assesses the student’s and their family’s financial situation to determine their Expected Family Contribution (EFC) towards college costs.

How can I maximize my chances of receiving scholarships?

+To maximize your chances of receiving scholarships, start by researching and identifying scholarships that align with your qualifications, interests, and background. Create a comprehensive list of scholarships and their requirements. Ensure you meet the eligibility criteria and submit well-crafted applications, including essays, recommendations, and supporting documents. Stay organized and submit your applications promptly to increase your chances of success.

Are there any resources available to help me create a budget?

+Yes, WSU provides various resources to assist students in creating a budget. The financial aid office offers budget planning tools and calculators to help you estimate your expenses and income. Additionally, there are online budgeting apps and templates available that can guide you in tracking your spending and creating a realistic budget. Seek guidance from financial aid counselors or utilize student support services for further assistance.

Can I appeal my financial aid award if I believe it is incorrect or insufficient?

+Yes, if you believe your financial aid award is incorrect or does not accurately reflect your financial situation, you can initiate an appeal process. Contact the financial aid office and explain your circumstances, providing supporting documentation to justify your appeal. The financial aid office will review your case and make a decision based on the available information. It’s important to communicate any changes in your financial situation promptly to ensure accurate aid awards.

How can I stay updated on scholarship deadlines and opportunities?

+Staying updated on scholarship deadlines and opportunities is crucial for maximizing your chances of receiving financial support. Subscribe to scholarship newsletters, follow reputable scholarship websites, and create Google Alerts with keywords related to scholarships. Attend financial aid workshops and information sessions on campus, where you can learn about new scholarship opportunities and receive guidance on the application process.