5 Ways To Create A Perfect Key Interest Rates Def Plan Now

Introduction to Key Interest Rates and their Impact

Understanding key interest rates is crucial for financial planning and economic stability. These rates, set by central banks, influence borrowing costs, investment decisions, and overall economic growth. By learning how to create a comprehensive interest rate plan, individuals and businesses can navigate the financial landscape more effectively. In this blog post, we will explore five essential steps to develop a robust key interest rate strategy, empowering you to make informed choices and achieve your financial goals.

Step 1: Research and Analyze Historical Data

The first step in crafting an effective interest rate plan is thorough research and analysis of historical data. By studying past interest rate trends, you can identify patterns, understand market behavior, and make more accurate predictions. Consider the following:

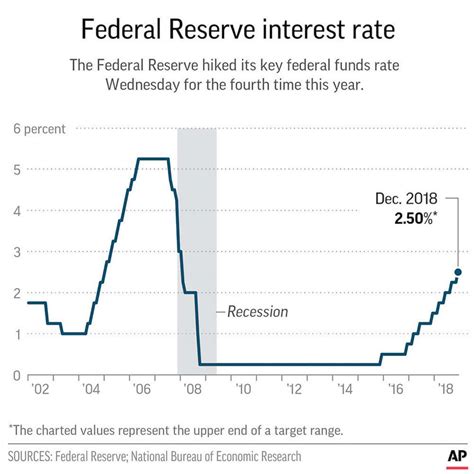

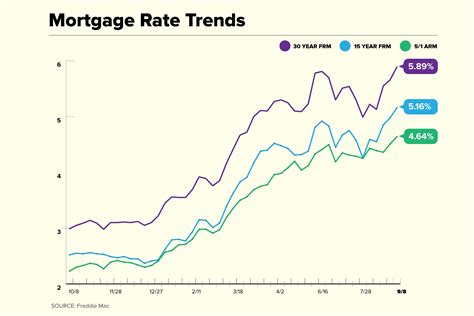

- Historical Interest Rate Data: Gather and analyze historical interest rate data for different economic cycles. Look for trends, peaks, and valleys to identify potential patterns.

- Economic Indicators: Research and monitor economic indicators such as GDP growth, inflation rates, unemployment rates, and consumer confidence. These indicators provide insights into the overall health of the economy and can help you anticipate interest rate movements.

- Central Bank Policies: Stay updated on central bank policies and announcements. Central banks often provide guidance on future interest rate decisions, which can influence your planning.

Step 2: Define Your Financial Goals and Objectives

Clearly defining your financial goals and objectives is essential for creating a tailored interest rate plan. Consider the following:

- Short-term Goals: Identify your short-term financial goals, such as saving for a down payment on a house or paying off high-interest debt. Understanding these goals will help you determine the appropriate interest rate strategy.

- Long-term Objectives: Outline your long-term financial objectives, including retirement planning, investing for growth, or funding a child’s education. Different interest rate scenarios may impact these objectives, so consider their implications.

- Risk Tolerance: Assess your risk tolerance. Are you comfortable with higher-risk investments for potentially higher returns, or do you prefer more conservative options? This will guide your interest rate plan.

Step 3: Diversify Your Investment Portfolio

Diversification is a key strategy to manage interest rate risk and optimize returns. Consider the following approaches:

- Asset Allocation: Allocate your investments across different asset classes, such as stocks, bonds, and cash equivalents. This diversification reduces the impact of interest rate changes on your overall portfolio.

- Fixed Income Investments: Include fixed-income investments like government bonds, corporate bonds, or certificates of deposit (CDs). These instruments provide a stable income stream and are less sensitive to interest rate fluctuations.

- Floating Rate Investments: Explore floating rate investments, such as variable-rate loans or floating rate notes. These instruments adjust their interest rates based on market conditions, offering potential benefits in a rising interest rate environment.

Step 4: Implement Interest Rate Hedging Strategies

Hedging is a risk management technique that can protect your investments from adverse interest rate movements. Consider the following strategies:

- Interest Rate Swaps: Interest rate swaps allow you to exchange fixed-rate payments for floating-rate payments or vice versa. This strategy can help you manage interest rate risk and optimize your cash flow.

- Interest Rate Caps and Floors: Implement interest rate caps to limit the maximum interest rate you pay on variable-rate loans, providing protection against rising rates. Conversely, interest rate floors can guarantee a minimum interest rate, offering stability in a falling rate environment.

- Treasury Inflation-Protected Securities (TIPS): Invest in TIPS, which are inflation-indexed bonds. These securities provide protection against inflation and can help preserve the purchasing power of your investments.

Step 5: Regularly Monitor and Adjust Your Plan

Interest rates are dynamic, and it’s crucial to regularly monitor and adjust your plan to stay aligned with market conditions. Here’s how:

- Market Analysis: Stay informed about market trends and economic developments. Monitor interest rate forecasts, central bank policies, and global economic indicators to anticipate potential changes.

- Performance Evaluation: Regularly evaluate the performance of your investment portfolio. Assess how different interest rate scenarios impact your returns and make adjustments as needed to maintain your desired risk-return profile.

- Rebalance Your Portfolio: Periodically rebalance your investment portfolio to maintain your desired asset allocation. This ensures that your investments remain aligned with your financial goals and risk tolerance.

Visual Representation: Interest Rate Strategies

| Strategy | Description | Benefits |

|---|---|---|

| Asset Allocation | Diversifying investments across asset classes | Reduces interest rate risk, optimizes returns |

| Fixed Income Investments | Investing in stable income streams | Provides income, less sensitive to interest rate changes |

| Floating Rate Investments | Adjusting interest rates based on market conditions | Potential benefits in a rising rate environment |

| Interest Rate Swaps | Exchanging fixed-rate for floating-rate payments | Manages interest rate risk, optimizes cash flow |

| Interest Rate Caps/Floors | Limiting maximum/minimum interest rates | Protects against rising/falling rates |

Conclusion

Creating a comprehensive key interest rate plan is essential for navigating the financial landscape successfully. By following these five steps—researching historical data, defining financial goals, diversifying your portfolio, implementing hedging strategies, and regularly monitoring your plan—you can make informed decisions and achieve your financial objectives. Remember, interest rates are dynamic, so staying agile and adapting your strategy is key to long-term success. With a well-thought-out interest rate plan, you can optimize your investments and achieve financial stability.

FAQ

How often should I review and adjust my interest rate plan?

+It is recommended to review your interest rate plan at least annually or whenever there are significant changes in the economic landscape or your personal financial situation. Regular reviews ensure that your plan remains aligned with your goals and the current market conditions.

What are the potential risks of not having an interest rate plan?

+Without an interest rate plan, you may be exposed to unexpected interest rate movements, which can impact your investment returns and financial stability. It increases the risk of making impulsive decisions and may lead to missed opportunities or financial losses.

Can I combine multiple hedging strategies for better protection?

+Yes, combining multiple hedging strategies can provide a more comprehensive risk management approach. However, it’s important to understand the interactions between different strategies and ensure they align with your financial goals and risk tolerance.

Are there any tax implications when implementing interest rate hedging strategies?

+The tax implications can vary depending on your jurisdiction and the specific hedging strategy. It’s advisable to consult with a tax professional to understand the potential tax consequences and ensure compliance with relevant regulations.

How can I stay updated on interest rate movements and market trends?

+Stay informed by following reputable financial news sources, subscribing to economic newsletters, and utilizing online resources and platforms that provide real-time market data and analysis. Additionally, consider consulting with financial advisors or experts who can provide insights and guidance.