5 Steps To Design The Ultimate Export Bill

Designing an export bill that meets all the necessary requirements and facilitates smooth international trade transactions is crucial for businesses. Here, we present a comprehensive guide to help you create the ultimate export bill, ensuring compliance and efficiency.

Step 1: Gather Essential Information

Before initiating the export bill process, it is vital to collect all the necessary details. This step sets the foundation for a well-structured and accurate bill.

Exporter’s Details

- Name and address of the exporter.

- Contact information, including phone numbers and email addresses.

- Tax identification number or other relevant business registration details.

Importer’s Information

- Complete name and address of the importer.

- Contact details to ensure effective communication.

- Importer’s tax or business registration information, if available.

Product Details

- A clear and concise description of the goods being exported.

- Product specifications, including dimensions, weight, and quantity.

- HS (Harmonized System) codes for accurate classification and customs purposes.

Shipping Information

- Port of loading and destination port.

- Mode of transportation (sea, air, or land freight).

- Estimated time of arrival (ETA) and any special shipping instructions.

Step 2: Choose the Right Bill Format

Export bills come in various formats, and selecting the appropriate one is essential. The format choice depends on the nature of the transaction, the parties involved, and the requirements of the importing country.

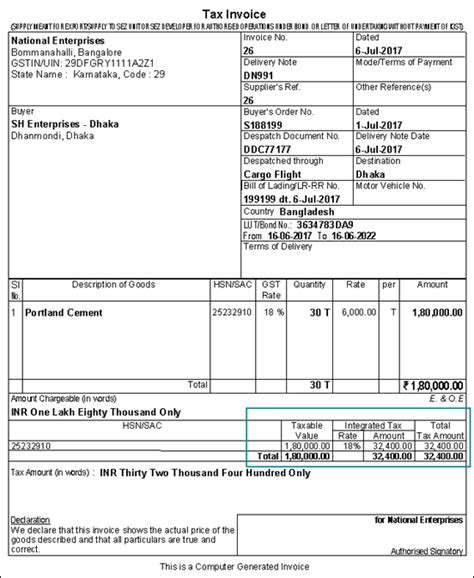

Common Bill Formats

- Commercial Invoice: This is the most common type, providing a detailed overview of the transaction. It includes product information, prices, and terms of sale.

- Proforma Invoice: Used as a preliminary estimate or quotation, often sent before the actual sale. It helps importers understand the potential costs and details of the transaction.

- Customs Invoice: Specifically designed for customs clearance, containing information required by the importing country’s customs authorities.

Consider the specific needs of your transaction and choose a bill format that aligns with the requirements of both the exporter and importer.

Step 3: Include Mandatory Elements

Every export bill must include certain mandatory elements to ensure compliance with international trade regulations. These elements provide crucial information for customs clearance and legal purposes.

Mandatory Elements for Export Bills

- Bill of Lading Number: A unique identifier for the shipment, provided by the shipping company.

- Date of Export: The actual date when the goods were shipped or handed over to the carrier.

- Terms of Sale: Clearly state the terms, such as FOB (Free On Board), CIF (Cost, Insurance, and Freight), or EXW (Ex-Works), indicating who bears the costs and risks of transportation.

- Payment Terms: Specify the agreed-upon payment method and any relevant details, such as due dates and accepted currencies.

- Country of Origin: Indicate the country where the goods were manufactured or produced.

- Packaging Details: Describe the type and quantity of packaging used, including any special markings or labels.

Step 4: Calculate and Include Costs

Accurate cost calculation is crucial for both the exporter and importer. It ensures transparency and helps avoid disputes or misunderstandings.

Cost Calculation and Inclusion

- Unit Price: Specify the price per unit of the goods being exported.

- Quantity: Clearly state the total quantity of goods being shipped.

- Total Value: Calculate and include the total value of the goods, taking into account any discounts or additional charges.

- Taxes and Duties: Determine and list the applicable taxes and duties, ensuring compliance with the importing country’s regulations.

- Freight Charges: Include the cost of transportation, considering the chosen mode of shipping.

- Insurance: If applicable, add the cost of insurance coverage for the goods during transit.

Step 5: Review and Finalize

Before finalizing the export bill, a thorough review is essential to ensure accuracy and completeness.

Review and Finalization Process

- Double-check Details: Verify all the information, including names, addresses, product descriptions, and quantities.

- Accuracy of Calculations: Recalculate the total value, taxes, and duties to ensure accuracy.

- Compliance with Regulations: Ensure the bill complies with the importing country’s regulations and any specific requirements set by the importer.

- Proofreading: Carefully proofread the bill for grammatical errors or typos that might cause confusion.

- Get Approval: Obtain necessary approvals from both the exporter and importer, if required.

Notes

🌐 Note: It is crucial to stay updated with the latest trade regulations and requirements of the importing country. Seek professional advice if needed to ensure compliance.

💼 Note: Consider using standardized templates or software to streamline the process and maintain consistency in your export bills.

Conclusion

Designing an export bill is a meticulous process that requires attention to detail and compliance with international trade regulations. By following these five steps, you can create an accurate and comprehensive export bill, facilitating smooth transactions and building trust with your international business partners. Remember, a well-structured export bill is a vital component of successful international trade.

FAQ

What is an export bill, and why is it important?

+

An export bill is a legal document that provides a detailed overview of an international trade transaction. It is important as it facilitates customs clearance, ensures compliance with regulations, and helps both parties understand the terms and costs of the transaction.

Can I use a generic template for my export bill?

+

While generic templates can be a good starting point, it is essential to customize the bill to meet the specific requirements of your transaction and the importing country’s regulations. Using a standardized template can help maintain consistency.

What happens if I forget to include mandatory elements in my export bill?

+Omitting mandatory elements can lead to delays in customs clearance and potential legal issues. It is crucial to review the bill thoroughly to ensure all required information is present.

How often should I update my export bill template?

+It is recommended to review and update your export bill template regularly, especially when there are changes in trade regulations or when you identify areas for improvement. Staying up-to-date ensures compliance and efficiency.