3. The Perfect 7Day Plan To Calculate Law School Expenses

Understanding Law School Expenses: A 7-Day Guide

Exploring the financial aspects of law school is crucial for prospective students. This 7-day plan will help you navigate the costs and create a comprehensive budget for your legal education journey.

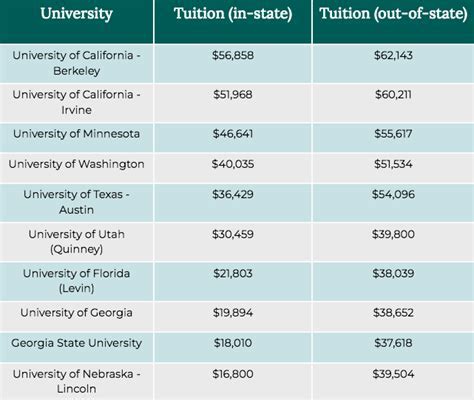

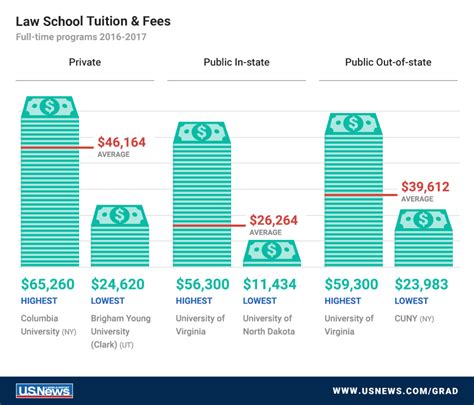

Day 1: Tuition Fees and Associated Costs

Begin by researching the tuition fees for your chosen law schools. Most law schools provide a detailed breakdown of tuition costs on their websites. Make a list of these fees and consider the following:

- Tuition Fees: Check the cost per credit hour or the annual tuition rate. Some schools offer discounts for early enrollment or have specific fee structures for part-time students.

- Mandatory Fees: Look for additional mandatory fees, such as technology fees, health center fees, or student activity fees. These can significantly impact your overall expenses.

- Books and Supplies: Estimate the cost of textbooks, legal research tools, and other necessary supplies. Textbook prices can vary, so consider used book options or digital alternatives to save money.

Day 2: Living Expenses and Budgeting

Understanding your living expenses is vital for creating a sustainable budget. Here’s what to consider:

- Housing: Research the cost of living in the area where your law school is located. Check rental prices, utilities, and any other housing-related expenses. Consider the option of living on or off-campus and compare the costs.

- Meal Plans: If you plan to live on campus, investigate meal plan options and their costs. Alternatively, budget for groceries and cooking expenses if you prefer off-campus living.

- Transportation: Calculate transportation costs, including public transport passes, gas, and parking fees. Consider the distance between your accommodation and the law school.

- Health Insurance: Check if your law school offers health insurance plans and their associated costs. Compare these with your current insurance coverage to determine the best option.

Day 3: Financial Aid and Scholarships

Exploring financial aid opportunities is essential to reduce your overall expenses. Here’s how to get started:

- Scholarships: Research merit-based and need-based scholarships offered by your law school. Check the eligibility criteria and application deadlines. Some scholarships may require essays or interviews, so plan accordingly.

- Grants: Look into federal and state grants, which are typically need-based. The Free Application for Federal Student Aid (FAFSA) is a crucial step in determining your eligibility for grants and other financial aid.

- Assistantships: Explore teaching or research assistantship opportunities at your law school. These positions often come with tuition waivers or stipends, significantly reducing your financial burden.

Day 4: Loan Options and Repayment Plans

Understanding loan options is crucial for managing your finances during and after law school. Consider the following:

- Federal Loans: Research federal loan programs, such as the Federal Direct Loan Program, which offers fixed interest rates and flexible repayment plans.

- Private Loans: Compare private loan options from various lenders. Consider factors like interest rates, repayment terms, and any additional fees. Private loans often have variable interest rates, so be cautious.

- Repayment Plans: Familiarize yourself with different repayment plans, such as income-driven repayment, extended repayment, or graduated repayment. Understanding these options will help you manage your loan payments post-graduation.

Day 5: Additional Expenses and Savings Strategies

Don’t forget to account for other expenses and explore savings strategies:

- Personal Expenses: Budget for personal care, entertainment, and any other miscellaneous expenses. These can add up quickly, so be mindful of your spending.

- Emergency Fund: Consider setting aside a portion of your budget for unexpected expenses. Having an emergency fund can provide financial security during unexpected situations.

- Savings Tips: Look for ways to save money, such as using student discounts, opting for cost-effective housing options, or cooking at home instead of eating out frequently. Every dollar saved counts!

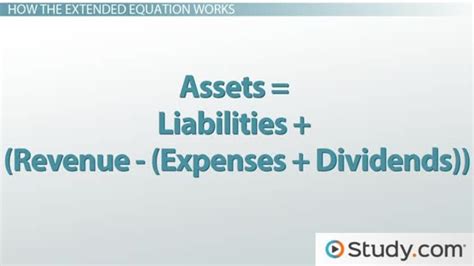

Day 6: Creating a Realistic Budget

Now, it’s time to put everything together and create a realistic budget:

- List All Expenses: Compile a comprehensive list of all your estimated expenses, including tuition, living costs, books, and any other relevant items.

- Determine Income Sources: Identify your income sources, such as scholarships, grants, loans, or personal savings.

- Allocate Funds: Allocate your income to cover each expense category. Be realistic and leave some wiggle room for unexpected costs.

- Review and Adjust: Regularly review your budget and make adjustments as needed. Law school expenses can vary, so staying flexible is essential.

Day 7: Seek Professional Advice and Stay Informed

Seeking professional advice and staying informed about financial matters is crucial:

- Financial Aid Office: Reach out to your law school’s financial aid office. They can provide personalized advice and assist you in navigating financial aid options.

- Stay Updated: Keep yourself informed about changes in financial aid policies, loan programs, and scholarship opportunities. Subscribe to relevant newsletters or follow reputable financial websites.

- Attend Workshops: Participate in financial planning workshops or events organized by your law school or local community. These can provide valuable insights and networking opportunities.

🧮 Note: This 7-day plan is a general guide. Every law school and student's financial situation is unique, so tailor your research and budgeting process accordingly.

Conclusion

Understanding and managing law school expenses is a crucial step towards a successful legal education journey. By following this 7-day plan, you can create a comprehensive budget, explore financial aid options, and make informed decisions about your finances. Remember, staying organized, seeking professional advice, and being mindful of your spending habits will contribute to a more financially stable law school experience.

FAQ

How do I estimate the cost of living near my law school accurately?

+Research local rental prices, utilities, and transportation costs. Use online tools and speak to current or former students to get a realistic estimate.

Are there any scholarships specifically for law students?

+Yes, many law schools offer merit-based and need-based scholarships. Research your school’s website and contact the financial aid office for more information.

What are the most common loan options for law students?

+Federal Direct Loans are popular due to their fixed interest rates and flexible repayment plans. Private loans are also an option, but be cautious of variable interest rates.

How can I reduce my living expenses during law school?

+Consider cost-effective housing options, cook at home instead of eating out, and take advantage of student discounts. Every dollar saved makes a difference.

What should I do if I need additional financial aid during law school?

+Reach out to your law school’s financial aid office. They can guide you through the process of applying for additional aid or exploring alternative funding options.