12 Tips To Maximise Your Grow Federal Credit Union Membership: The Essential Guide

Introduction

As a member of Grow Federal Credit Union, you have access to a wide range of financial services and benefits. To make the most of your membership and ensure you’re taking advantage of all the perks, here are 12 essential tips to maximize your experience.

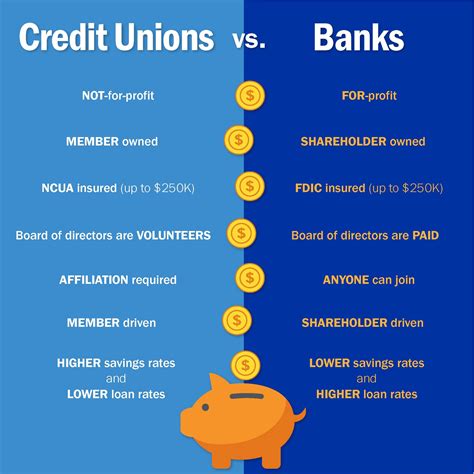

1. Understand the Credit Union Difference

Grow Federal Credit Union is not your typical bank. It is a member-owned, not-for-profit financial institution. This means it operates with its members’ best interests in mind, focusing on providing excellent service and competitive rates. Unlike traditional banks, credit unions offer more personalized experiences and often have lower fees and better loan terms.

2. Explore the Variety of Accounts

Grow FCU offers a diverse range of accounts to suit your financial needs. From basic checking and savings accounts to specialized options like health savings accounts (HSAs) and certificates of deposit (CDs), there’s an account for every purpose. Take the time to understand the features and benefits of each account type to choose the ones that align with your financial goals.

3. Take Advantage of Free Services

Grow FCU provides several free services that can save you money and time. These include:

- Free online banking and mobile app: Access your accounts, pay bills, and transfer funds securely from anywhere.

- Free ATMs: Locate surcharge-free ATMs using the CO-OP Network, a vast network of credit union ATMs across the country.

- Free financial counseling: Receive personalized advice and guidance to help you manage your finances effectively.

4. Utilize Low-Cost Loans

One of the significant advantages of credit unions is their ability to offer low-interest loans. Grow FCU provides competitive rates on various loan types, including auto loans, personal loans, and mortgages. Take advantage of these loan options to save money on interest and potentially reduce your overall debt.

5. Build Your Credit Score

Grow FCU offers credit-building opportunities to help improve your credit score. Consider applying for a secured credit card or a small personal loan. These options can help you establish a positive credit history and demonstrate your financial responsibility.

6. Participate in Dividend Programs

As a member-owned institution, Grow FCU returns a portion of its profits to its members in the form of dividends. Keep an eye out for dividend programs and take advantage of them to boost your savings or reduce your loan balances.

7. Explore Insurance Options

Grow FCU partners with trusted insurance providers to offer members exclusive rates on various insurance products. Consider exploring options for auto, home, life, and health insurance to ensure you have adequate coverage at competitive prices.

8. Take Advantage of Discount Programs

Grow FCU often partners with local businesses and organizations to provide members with exclusive discounts and perks. These can include discounts on dining, entertainment, travel, and more. Stay updated on these partnerships to make the most of your membership.

9. Attend Financial Workshops

Grow FCU hosts educational workshops and seminars to help members improve their financial literacy. These events cover a range of topics, from budgeting and saving to investing and retirement planning. Attending these workshops can empower you to make informed financial decisions.

10. Utilize Online and Mobile Banking

Grow FCU’s online and mobile banking platforms offer a convenient way to manage your finances. With these tools, you can:

- Check account balances and transaction history.

- Transfer funds between accounts.

- Pay bills and set up automatic payments.

- Deposit checks remotely using mobile deposit.

- Receive real-time alerts and notifications.

11. Stay Informed with Newsletters and Updates

Subscribe to Grow FCU’s newsletters and updates to stay informed about the latest products, services, and promotions. This will help you stay up-to-date with any changes or improvements that could benefit your financial situation.

12. Refer Friends and Family

Grow FCU often has referral programs that reward members for referring new members. By referring friends and family, you can help them access the same great services and benefits you enjoy, while also earning rewards for yourself.

Conclusion

Maximizing your Grow Federal Credit Union membership involves understanding the unique benefits of credit unions, exploring the various account options, and taking advantage of the free services and low-cost loans available. By actively participating in dividend programs, exploring insurance options, and staying informed about discounts and educational opportunities, you can make the most of your membership and achieve your financial goals. Remember to utilize the online and mobile banking platforms for convenient access to your accounts and stay engaged with the credit union’s newsletters and updates.

💡 Note: Keep an eye on the official Grow FCU website and social media channels for the latest updates and promotions.

FAQ

What are the benefits of joining Grow Federal Credit Union over a traditional bank?

+

Grow FCU offers a more personalized and member-focused experience with lower fees, better loan terms, and higher dividends on savings. Credit unions are not-for-profit, so they prioritize their members’ financial well-being over profits.

How can I open an account with Grow Federal Credit Union?

+

To open an account, you’ll need to meet the eligibility criteria, which typically includes residing or working within a specific geographic area or being affiliated with a select group. You can visit a branch, apply online, or call their customer service for assistance.

What are the eligibility requirements for Grow Federal Credit Union membership?

+

Eligibility requirements vary, but common criteria include living or working in a specific geographic area, being a member of an affiliated group or organization, or having a family member who is already a member. Check the credit union’s website or contact them directly for specific details.

Can I access my Grow FCU account from anywhere in the world?

+

Yes, you can access your Grow FCU account from anywhere with an internet connection. Their online and mobile banking platforms are designed for remote access, allowing you to manage your finances securely and conveniently.