10 Navy Federal Benefits: Unlocking Essential Member Privileges

Welcome to the Navy Federal Community: Uncovering Exclusive Member Advantages

The Navy Federal Credit Union, often referred to as Navy Federal, is a member-owned financial cooperative with a rich history of serving the military community. With a commitment to providing financial services and benefits tailored to the unique needs of military personnel and their families, Navy Federal has become a trusted partner for many. In this blog post, we will explore ten remarkable benefits that Navy Federal offers to its members, shedding light on the advantages that make it a popular choice for those in the military and related fields.

1. Competitive Interest Rates

One of the standout features of Navy Federal is its competitive interest rates on a wide range of financial products. Whether you’re looking to purchase a home, refinance your mortgage, or secure a personal loan, Navy Federal often offers rates that are lower than those of traditional banks. This can result in significant savings over the life of your loan, making it an attractive option for members seeking the best financial deals.

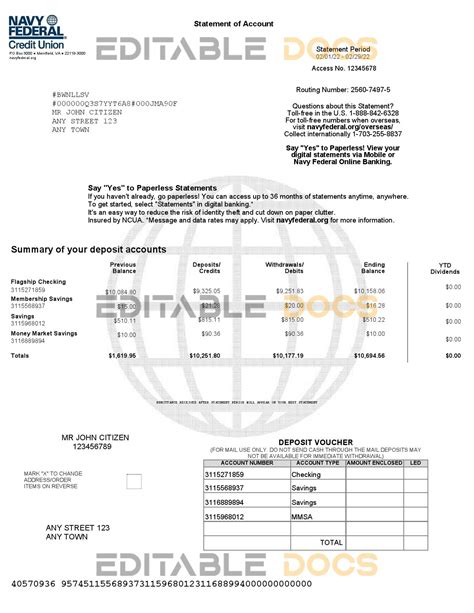

2. Low or No Fees

Navy Federal is known for its commitment to keeping fees low or eliminating them altogether for many of its services. This includes waiving monthly maintenance fees on checking and savings accounts, as well as offering free ATM access at Navy Federal ATMs and select partner ATMs worldwide. Additionally, members can enjoy free checks, free online and mobile banking, and even free credit score monitoring, ensuring that their financial management is both efficient and cost-effective.

3. Military-Friendly Products and Services

Designed with the unique needs of military personnel in mind, Navy Federal offers a comprehensive suite of military-friendly products and services. This includes specialized loans and financial planning services tailored to the military lifestyle. For instance, members can access VA loans, which offer favorable terms for eligible military borrowers, and benefit from the expertise of Navy Federal’s military-trained financial advisors who understand the complexities of military pay and benefits.

4. Robust Online and Mobile Banking

In today’s digital age, convenient and secure online and mobile banking are essential. Navy Federal excels in this area, providing members with a user-friendly online platform and mobile app that allow for easy account management and transactions. Members can check their balances, transfer funds, pay bills, and even deposit checks remotely, ensuring that they can stay on top of their finances regardless of their location or deployment status.

5. Extensive Branch and ATM Network

Navy Federal maintains a vast network of branches and ATMs across the United States, making it convenient for members to access their financial services regardless of their location. This extensive network is particularly beneficial for military personnel who may be frequently on the move or stationed in remote areas. With over 300 branches and thousands of ATMs, members can rest assured that their financial needs can be met wherever they are.

6. Award-Winning Customer Service

Navy Federal takes pride in its award-winning customer service, which is consistently rated highly by members. The credit union’s dedicated team of professionals is known for their expertise, friendliness, and willingness to go the extra mile to assist members. Whether it’s answering questions about a loan application, providing guidance on investment options, or helping with a technical issue, Navy Federal’s customer service representatives are always ready to provide personalized support.

7. Financial Education and Resources

Understanding personal finance is crucial, and Navy Federal recognizes this by offering a wealth of educational resources and tools to its members. This includes access to financial literacy courses, budgeting tools, and resources for managing debt. Members can also benefit from personalized financial planning services, ensuring that they have the knowledge and support needed to make informed financial decisions and achieve their long-term goals.

8. Rewards and Discounts

Navy Federal rewards its members with exclusive discounts and rewards on a variety of products and services. This includes discounts on insurance, travel, and entertainment, as well as cash back and rewards programs for eligible credit cardholders. Members can also take advantage of special offers and promotions, ensuring that they not only save on their financial services but also on other aspects of their daily lives.

9. Security and Fraud Protection

Protecting members’ financial information and assets is a top priority for Navy Federal. The credit union employs advanced security measures, including encryption technology and fraud monitoring systems, to safeguard members’ accounts and personal data. Additionally, Navy Federal provides resources and guidance on how to identify and prevent fraud, ensuring that members can bank with confidence and peace of mind.

10. Community Involvement and Giving Back

Navy Federal is deeply committed to giving back to the communities it serves. The credit union actively supports various charitable causes and initiatives, particularly those focused on military families and veterans. Through its community involvement programs, Navy Federal makes a positive impact on the lives of those it serves, fostering a sense of connection and gratitude within its membership.

Conclusion

Navy Federal Credit Union offers a comprehensive suite of benefits and services tailored to the unique needs of military personnel and their families. From competitive interest rates and low fees to military-friendly products, robust digital banking, and award-winning customer service, Navy Federal provides a holistic financial experience. With its commitment to education, security, and community involvement, Navy Federal stands as a trusted partner, empowering its members to achieve their financial goals and thrive in their military careers.

Frequently Asked Questions

Is Navy Federal membership exclusive to military personnel and their families?

+

No, while Navy Federal has a rich history of serving the military community, it also welcomes members from other fields. Eligibility extends to Department of Defense (DoD) civilian employees, contractors, and retirees, as well as their family members. Additionally, members of select other organizations and associations may also be eligible for membership.

What types of loans does Navy Federal offer, and what are the eligibility criteria?

+

Navy Federal offers a range of loan products, including mortgage loans, auto loans, personal loans, and credit cards. Eligibility criteria vary depending on the loan type and may include factors such as credit score, income, and membership status. Members can explore their loan options and eligibility through Navy Federal’s online loan application process or by speaking with a financial advisor.

How can I access Navy Federal’s financial education resources and tools?

+

Navy Federal provides a wealth of financial education resources and tools through its website and mobile app. Members can access budgeting tools, financial literacy courses, and resources for managing debt by logging into their online accounts or by downloading the Navy Federal mobile app. Additionally, members can schedule appointments with financial advisors for personalized guidance and support.

What security measures does Navy Federal have in place to protect my financial information and assets?

+

Navy Federal employs robust security measures to safeguard members’ financial information and assets. This includes encryption technology to protect data during transmission, multi-factor authentication for account access, and fraud monitoring systems to detect and prevent suspicious activity. Members can also take advantage of resources and guidance on how to identify and prevent fraud, ensuring a secure banking experience.

How can I get involved with Navy Federal’s community involvement initiatives and giving back programs?

+

Navy Federal welcomes member involvement in its community involvement initiatives and giving back programs. Members can explore volunteer opportunities, donate to select charitable causes, and participate in community events through the credit union’s website or by contacting their local branch. Navy Federal’s commitment to community involvement provides members with a meaningful way to give back and make a positive impact.