10+ Fsa Contribution Strategies: Essential Tips For 2025

Understanding FSA Contributions

A Flexible Spending Account (FSA) is a tax-advantaged account that allows you to set aside pre-tax income to pay for eligible healthcare expenses and certain dependent care costs. It’s an excellent way to save money and plan for your healthcare needs. With 2025 approaching, now is the time to explore effective strategies to maximize your FSA contributions and make the most of this financial tool.

Choosing the Right FSA Plan

Before diving into contribution strategies, it’s crucial to select the right FSA plan for your needs. There are two primary types of FSAs:

Healthcare FSA (HSA): This account is specifically for healthcare-related expenses, including copays, deductibles, and prescription medications. It offers flexibility and tax benefits, making it an attractive option for many individuals.

Dependent Care FSA (DCFSA): Focused on dependent care costs, this account can be used for expenses related to childcare or eldercare. It provides relief for families with dependent care needs.

Maximizing Your FSA Contributions

1. Assess Your Healthcare Needs

The first step in maximizing your FSA contributions is to evaluate your healthcare needs for the upcoming year. Consider factors such as:

- Prescription Medications: If you require ongoing medication, calculate the cost for the entire year.

- Regular Healthcare Visits: Estimate the frequency and cost of doctor’s appointments, specialist visits, or routine check-ups.

- Medical Procedures: Plan for any known medical procedures or surgeries you may need.

- Vision and Dental Care: Include expenses for eye exams, glasses, contacts, and dental treatments.

2. Calculate the Maximum Contribution

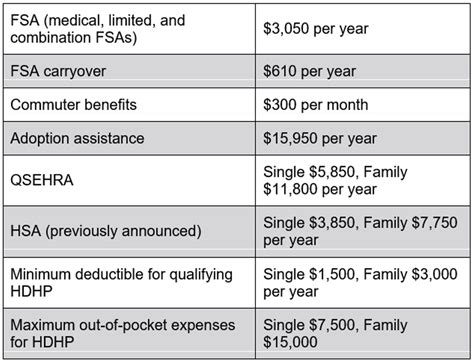

FSA plans have annual contribution limits, which vary depending on the type of account and your employer’s policy. For 2025, the contribution limits are:

- Healthcare FSA: $2,850 (maximum)

- Dependent Care FSA: 5,000 (maximum) for single or married filing jointly; 2,500 (maximum) for married filing separately

3. Spread Out Your Contributions

To avoid overspending or underspending, consider spreading out your FSA contributions throughout the year. Here’s how:

- Payroll Deductions: Set up regular payroll deductions to contribute to your FSA. This ensures a steady flow of funds into your account.

- Adjust Deductions: If your healthcare needs change, you can adjust your payroll deductions accordingly.

4. Take Advantage of Grace Periods

Many FSA plans offer a grace period, typically lasting until March 15th of the following year, to use any remaining funds from the previous year. Make the most of this grace period by:

- Reviewing Expenses: Go through your healthcare expenses and ensure you’ve claimed all eligible costs.

- Plan Ahead: If you have remaining funds, consider scheduling any necessary healthcare appointments or procedures during the grace period.

5. Use FSA-Eligible Products and Services

To maximize your FSA benefits, familiarize yourself with the wide range of products and services that are eligible for reimbursement. These include:

- Prescription Medications: Both brand-name and generic medications are eligible.

- Over-the-Counter (OTC) Medications: Certain OTC medications, such as pain relievers and allergy medicines, are covered if prescribed by a healthcare provider.

- Medical Supplies: Items like bandages, thermometers, and blood sugar monitors are eligible.

- Vision and Dental Care: Eyeglasses, contact lenses, and dental treatments are typically covered.

- Preventive Care: Routine check-ups, vaccinations, and screenings are often reimbursed.

6. Utilize FSA-Compatible Apps and Tools

In today’s digital age, there are numerous apps and tools designed to simplify FSA management. Consider using:

- FSA Administrator Apps: These apps, provided by your FSA administrator, allow you to track expenses, submit claims, and manage your account on the go.

- Healthcare Tracking Apps: Apps like MyFitnessPal or Fitbit can help you monitor your healthcare needs and expenses.

- Pharmacy Apps: Some pharmacy apps offer features to manage prescriptions and track medication costs.

7. Understand FSA Rollover and Carryover Options

Some FSA plans offer rollover or carryover options, allowing you to carry forward a portion of your unused funds into the next year. Here’s what you need to know:

- Rollover: With a rollover, a limited amount (often $500) of unused funds can be carried over to the following year.

- Carryover: Carryover plans allow a certain percentage (typically 20-50%) of unused funds to be carried over, providing more flexibility.

8. Plan for Dependent Care Expenses

If you have a Dependent Care FSA, consider the following strategies:

- Estimate Costs: Calculate the annual cost of childcare or eldercare.

- Explore Reimbursement Options: Check if your childcare provider accepts FSA payments directly.

- Plan for Emergencies: Keep some funds in your DCFSA for unexpected dependent care needs.

9. Consider Pre-Tax Benefits

FSAs offer pre-tax benefits, reducing your taxable income. This can result in significant tax savings. To maximize this advantage:

- Consult a Tax Professional: Discuss your FSA contributions with a tax expert to understand the potential tax benefits.

- Optimize Your Tax Strategy: Use your FSA contributions as part of a broader tax planning strategy.

10. Stay Informed About FSA Changes

FSA regulations and contribution limits can change annually. Stay updated by:

- Following FSA News: Keep an eye on financial news and updates related to FSAs.

- Attend Employer Meetings: Attend any FSA-related meetings or webinars organized by your employer.

- Read FSA Plan Documents: Review the plan documents provided by your employer to understand any changes.

Additional Tips for FSA Success

- Keep Receipts: Always keep a record of your FSA-eligible expenses. Many employers require receipts for reimbursement.

- Understand FSA Limits: Be aware of any limits on specific expenses, such as prescription medications or dental procedures.

- Use FSA Cards: If your plan offers an FSA card, use it for eligible purchases to simplify the reimbursement process.

- Review Expense Guidelines: Familiarize yourself with the specific guidelines and eligible expenses for your FSA plan.

Visual Guide to FSA Contributions

To further illustrate the process of maximizing your FSA contributions, here’s a simple table:

| Step | Action |

|---|---|

| 1 | Assess healthcare needs and estimate expenses. |

| 2 | Calculate maximum contribution based on FSA type. |

| 3 | Spread out contributions via payroll deductions. |

| 4 | Utilize grace period for remaining funds. |

| 5 | Purchase FSA-eligible products and services. |

Conclusion

Maximizing your FSA contributions for 2025 involves careful planning and an understanding of the available options. By assessing your healthcare needs, choosing the right FSA plan, and utilizing various strategies, you can make the most of this tax-advantaged account. Remember to stay informed about FSA changes and take advantage of the resources available to manage your account effectively. With these strategies in mind, you’ll be well-prepared to navigate the world of FSAs and make the most of your healthcare savings.

FAQ

Can I contribute to both a Healthcare FSA and a Dependent Care FSA simultaneously?

+Yes, you can contribute to both FSAs at the same time. However, it’s important to note that the contribution limits for each type of FSA are separate. Make sure to stay within the annual limits for each account to avoid penalties.

What happens if I have unused funds in my FSA at the end of the year without a grace period or rollover option?

+If your FSA plan does not offer a grace period or rollover option, any unused funds at the end of the year will be forfeited. It’s essential to plan your contributions carefully and use your FSA funds wisely to avoid losing any money.

Can I use my FSA for alternative medicine treatments like acupuncture or chiropractic care?

+Yes, many alternative medicine treatments are eligible for FSA reimbursement. However, it’s important to check with your FSA administrator or plan documents to confirm which specific treatments are covered. Some plans may require a prescription or a letter of medical necessity from a healthcare provider.

Are there any restrictions on using my FSA for over-the-counter medications?

+While over-the-counter medications are generally eligible for FSA reimbursement, there are some restrictions. Certain OTC medications, such as those containing alcohol or caffeine, may not be covered. Additionally, some plans may require a prescription or a letter of medical necessity for specific OTC medications. Check with your FSA administrator for more details.

Can I use my FSA funds for fitness-related expenses like gym memberships or fitness equipment?

+Unfortunately, FSA funds cannot be used for general fitness expenses like gym memberships or fitness equipment. However, certain fitness-related expenses may be eligible if they are prescribed by a healthcare provider for a specific medical condition. Check with your FSA administrator or plan documents for more information.