1. The Ultimate Guide To Perfecting Your Due Diligence Declaration

Understanding Due Diligence Declaration

Due diligence declaration is a crucial process that involves thorough research and investigation to assess the risks and potential rewards associated with a particular investment or business venture. It is an essential step for any investor or business owner to make informed decisions and mitigate potential pitfalls. In this comprehensive guide, we will delve into the world of due diligence, exploring its significance, the key components, and the steps to create a robust due diligence declaration. By the end of this article, you will have a clear understanding of how to navigate the due diligence process effectively and protect your interests.

The Importance of Due Diligence

Due diligence serves as a protective measure, ensuring that investors and businesses have a comprehensive understanding of the opportunities and risks they are about to undertake. It is a critical tool for minimizing potential losses and maximizing the chances of success. By conducting a thorough due diligence investigation, you can uncover vital information that may not be readily available or disclosed by the other party.

Key Components of Due Diligence

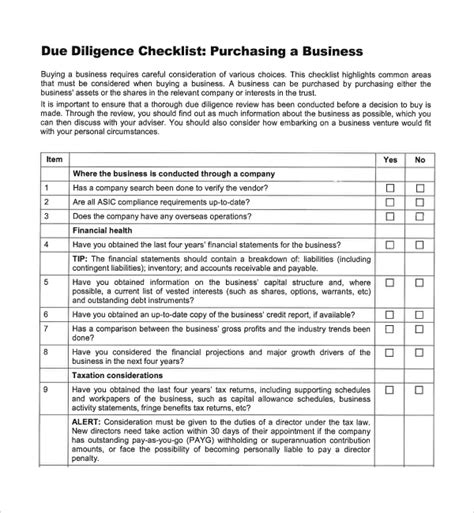

When performing due diligence, there are several key areas that need careful examination. These components provide a holistic view of the investment or business venture and help identify potential red flags. Here are the crucial aspects to consider:

Financial Health: A thorough analysis of the financial statements, cash flow, and overall financial stability of the target company is essential. This includes assessing revenue streams, debt obligations, and profitability.

Legal and Regulatory Compliance: Investigating the legal and regulatory landscape is vital to ensure the target company operates within the boundaries of the law. Check for any ongoing legal disputes, compliance issues, or potential regulatory risks.

Market Position and Competition: Understanding the target company’s market position and its competitors is crucial. Analyze market share, growth potential, and the competitive landscape to evaluate the sustainability of the business.

Management and Leadership: Assessing the competence and integrity of the management team is essential. Evaluate their experience, track record, and ability to lead the company toward success.

Operational Efficiency: Examine the target company’s operational processes, including supply chain management, production capabilities, and cost structure. Identify any inefficiencies or potential bottlenecks that may impact the business’s performance.

Environmental, Social, and Governance (ESG) Factors: With increasing focus on sustainability and ethical practices, evaluating the target company’s ESG performance is becoming a critical aspect of due diligence. Assess their environmental impact, social responsibility initiatives, and governance practices.

Intellectual Property: Intellectual property rights are valuable assets for any business. Conduct a thorough review of the target company’s patents, trademarks, copyrights, and trade secrets to ensure their protection and ownership.

Customer and Supplier Relationships: Understanding the target company’s relationships with its customers and suppliers is crucial. Assess the quality of these relationships, potential dependencies, and any contractual obligations.

Technology and Innovation: Evaluate the target company’s technological capabilities and its ability to adapt to industry advancements. Assess their research and development activities, intellectual property portfolio, and technology infrastructure.

Human Resources and Talent Management: A thorough review of the target company’s human resources practices, including employee satisfaction, talent retention, and training programs, is essential. Assess the potential risks associated with labor disputes or turnover.

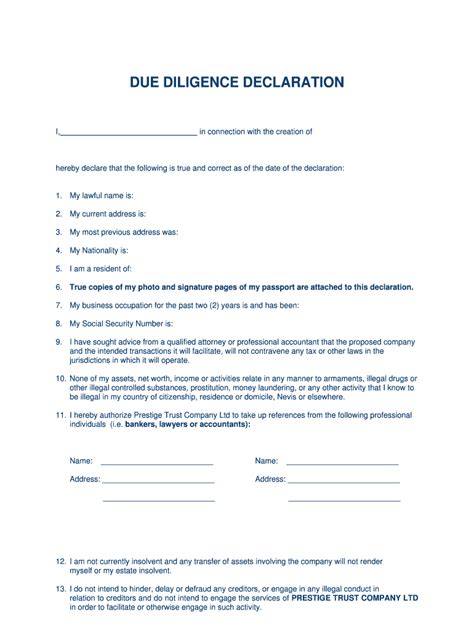

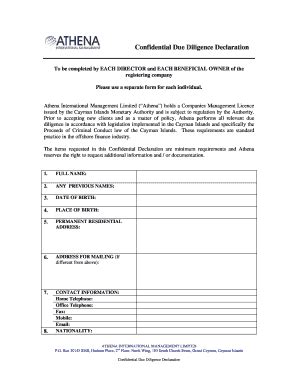

Steps to Create a Due Diligence Declaration

Now that we have covered the key components of due diligence, let’s explore the steps to create a comprehensive due diligence declaration:

Step 1: Define the Scope

Start by clearly defining the scope of your due diligence investigation. Determine the specific areas of interest and the depth of analysis required. This step helps you focus your efforts and allocate resources efficiently.

Step 2: Gather Information

Collect all relevant documents, financial statements, legal agreements, and other materials provided by the target company. Request additional information if needed to fill any gaps in your understanding.

Step 3: Conduct a Detailed Analysis

Analyze the gathered information thoroughly. Use financial ratios, industry benchmarks, and other analytical tools to evaluate the target company’s performance, financial health, and growth prospects. Assess the risks and potential rewards associated with the investment.

Step 4: Verify and Validate

Cross-reference the information obtained from the target company with external sources. Verify the accuracy of financial statements, legal compliance, and other critical aspects. Conduct site visits, interviews with key personnel, and due diligence calls to gather additional insights.

Step 5: Identify Red Flags and Risks

During your analysis, identify any potential red flags or risks that may impact the investment or business venture. These could include financial irregularities, legal disputes, operational inefficiencies, or environmental concerns. Evaluate the severity and likelihood of these risks and their potential impact on the target company’s performance.

Step 6: Develop Mitigation Strategies

Based on the identified risks, develop mitigation strategies to address them effectively. This may involve negotiating contract terms, implementing additional due diligence checks, or seeking expert advice from professionals in specific fields. Ensure that you have a plan in place to manage and minimize potential risks.

Step 7: Document Findings and Recommendations

Compile your findings and recommendations into a comprehensive due diligence report. Include a detailed analysis of the target company’s financial health, market position, management capabilities, and any identified risks. Provide clear and actionable recommendations to guide decision-making.

Step 8: Review and Revise

Before finalizing your due diligence declaration, review and revise your findings and recommendations. Seek input from experts, legal counsel, or industry professionals to ensure the accuracy and comprehensiveness of your report. Make any necessary adjustments to reflect the most up-to-date information and insights.

Conclusion

Due diligence declaration is a critical process that requires a systematic and thorough approach. By understanding the key components and following the steps outlined in this guide, you can navigate the due diligence process effectively and make well-informed investment or business decisions. Remember, due diligence is an ongoing process, and staying vigilant throughout the investment lifecycle is essential to mitigate risks and maximize returns.

FAQ

What is the primary purpose of due diligence?

+Due diligence is conducted to assess the risks and potential rewards associated with a particular investment or business venture. It helps investors and businesses make informed decisions by providing a comprehensive understanding of the target company’s financial health, market position, and other critical aspects.

How long does the due diligence process typically take?

+The duration of the due diligence process can vary depending on the complexity of the investment or business venture. It can range from a few weeks to several months. The time required is influenced by factors such as the availability of information, the depth of analysis needed, and the level of cooperation from the target company.

What are some common red flags to look out for during due diligence?

+Common red flags to watch out for include financial irregularities, such as unexplained accounting practices or discrepancies in financial statements. Legal disputes, ongoing litigation, or regulatory issues can also raise concerns. Additionally, operational inefficiencies, poor management practices, or a lack of transparency may indicate potential risks.

How can due diligence help mitigate risks?

+Due diligence plays a crucial role in risk mitigation by providing a comprehensive analysis of the target company’s financial health, legal compliance, market position, and operational efficiency. It helps identify potential risks and allows investors and businesses to make informed decisions, negotiate favorable terms, and implement mitigation strategies to minimize potential losses.

What are some best practices for conducting due diligence?

+Some best practices for conducting due diligence include defining a clear scope, gathering comprehensive information, conducting thorough analysis, and verifying the accuracy of data. It is also essential to involve experts and professionals in specific fields to gain specialized insights. Regular communication and collaboration with the target company are crucial for a successful due diligence process.